January 26, 2022

2022 Key Risks in Context

Tim Urbanowicz, CFA

Head of Research & Investment Strategy

Innovator Capital Management

After a stellar decade-long run, balanced portfolios seem to be running into trouble in 2022. A 40-year high inflation print, rising yields, and a hawkish Fed may have spooked equity and fixed income investors. And as usual, there is no shortage of theoretical comparisons using historical data sets speculating on how portfolios might behave if yields continue to rise or the Fed hikes aggressively. But this time around, there are several unique factors influencing the market that we believe investors should consider as they evaluate risk and position their portfolios accordingly in 2022.

#1 -- Market-weighted equities may have more sensitivity to a rise in yields than they did a decade ago.

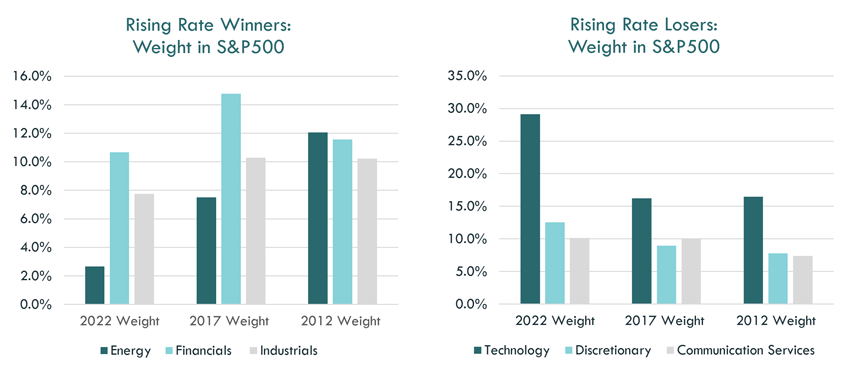

The U.S. equity market looks very different now than it did a decade ago. Technology, communication services, and consumer discretionary stocks -- underperformers when real rates increase -- make up roughly 52% of the S&P 500 today. That’s a 20% increase over the last 10 years. On the flip side, energy, financials, and industrials, the white knights when real rates rise, account for just 21% of the index, 14% less than their weighting 10 years ago.

Source: Bloomberg LP as of 12/31/2021

#2 --Core bond allocations may be more vulnerable to higher yields today, with less cushion

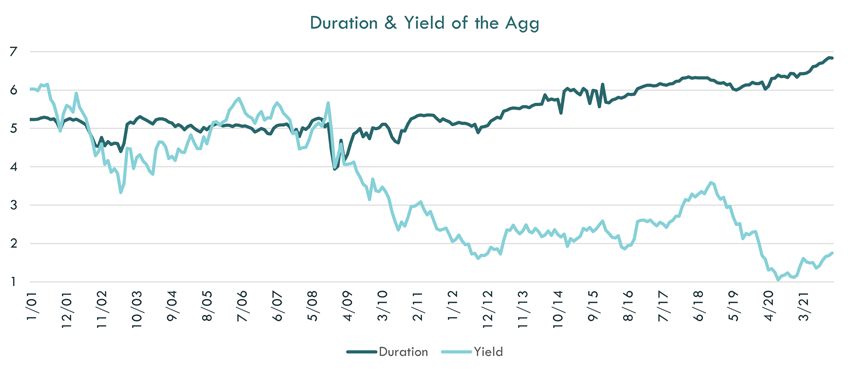

Like equities, core bond allocations look much different than they have in the past. As rates fell, issuers capitalized, refinancing and securing debt further out into the future. The result for investors is a lower yield and longer duration for core bonds.

Source: Bloomberg LP as of 12/31/2021

#3 -- The Fed will likely need to taper and hike in tandem…something it’s never done before

The Fed’s balance sheet has ballooned, rising from ~19% of GDP (Gross Domestic Product) at the start of the pandemic to ~38% today. To put that in context, when QE31 ended after the financial crisis in 2014, the balance sheet sat at 25.5% of GDP and it wasn’t until December of 2015 that rate hikes began. In 2022, the Fed will attempt to taper and hike rates at the same time, something that has never been done before. They will also need to carefully toe the line between fighting inflation without stalling growth.

#4 -- Be aware of the risks and potential drag from high valuations. Earnings will need to deliver.

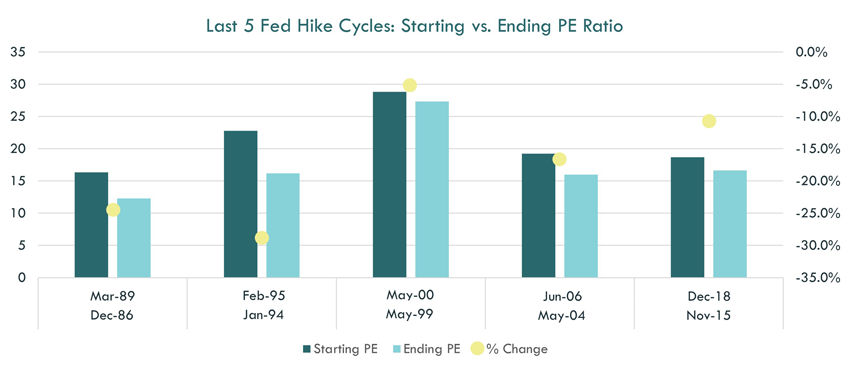

Any way you slice it, equities are expensive. Even with the haircut so far this year, the forward PE2 of 20x on the S&P is still multiple standard deviations above the norm. Historically, looking at the last five Fed hiking cycles, equity valuations fell each time. (See chart below). Admittingly, earnings growth delivered each time and total returns were positive but the only time valuations were higher than they are now was during the tech bubble. With recent returns potentially bolstered by rising multiples and a Fed eyeing 3+ hikes in 2022, investors will likely need to rely on stellar earnings growth once again for support.

Source: Bloomberg LP, S&P 500 Index, Monthly Price/Earnings Ratio Implications for Portfolios

At the end of the day, equities and bonds share the same key risks of higher yields and an overly aggressive Fed. The bond and equity selloff that started the year reflects that well. Finding alternative ways to hedge portfolio risks given today’s unique set of circumstances will be crucial.

Today's market is unique … position accordingly.

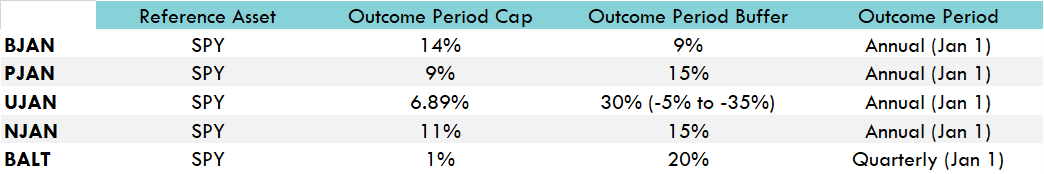

Buffer ETFs seek to provide upside equity exposure up to a pre-determined cap with a downside buffer over the outcome period. We believe these ETFs may be a powerful tool for portfolio construction this year, allowing investors to narrow the range of potential return outcomes and remain in control of portfolio risk, without allocating to bonds.

1. QE3, or Quantitative easing, refers to steps that the U.S. Federal Reserve takes in attempting to boost the country's lagging economy. This involves purchasing bonds.

2. Forward PE is a measure of value dividing a companies current market price by the estimated future earnings per share.

Defined Outcome ETFs have characteristics unlike many other traditional investment products and may not be suitable for all investors. For more information regarding whether an investment in the Fund is right for you, please see "Investor Suitability" in the prospectus.

An Important Note about Buffers and Bonds

Buffer ETFs seek to track the return of an equity-based reference asset, to a cap, while targeting a 9%, 15%, 20% or 30% buffer against losses over the outcome period. Buffer ETFs carry equity risk, which has historically been greater than bond risk. In order to produce a positive return, Buffer ETFs need equities to rise. If the equities fall more than the predetermined buffer, investors risk a loss.

Unlike bonds, Buffer ETFs will not rise when equities fall. Unlike equities, bonds pay coupons and their returns are not directly tied to the equity market. The price of a bond does not need to increase for an investor to profit. In addition, the price of a bond can also be affected by supply and demand. As a result bonds price have historically risen when equities have fallen as investors seek safety outside of equities.. Bonds have maturity dates at which point principal must be repaid or a default occurs. Bonds are higher in the capital structure than equities and therefore carry significantly lower risk of loss.

In addition, Buffer ETFs do not seek to provide income which is the typical investment objective of bond funds. Options provide exposure to the price return of the respective reference asset and therefore investors do not receive dividends or investment income through an investment in a Buffer ETF.

The funds only seek to provide their investment objective, which is not guaranteed, over the course of an entire outcome period. Investors who purchase shares after or sell shares before the end of an outcome period will experience very different outcomes than the funds seek to provide.

The Funds have characteristics unlike many other traditional investment products and may not be suitable for all investors. For more information regarding whether an investment in the Fund is right for you, please see Investor Suitability" in the prospectus.

The Funds are designed to provide point-to-point exposure to the price return of a reference asset via a basket of Flex Options. As a result, the ETFs are not expected to move directly in line with the reference asset during the interim period. Additionally, FLEX Options may be less liquid than standard options. In a less liquid market for the FLEX Options, the Fund may have difficulty closing out certain FLEX Options positions at desired times and prices.

Fund shareholders are subject to an upside return cap (the Cap) that represents the maximum percentage return an investor can achieve from an investment in the funds' for the Outcome Period, before fees and expenses. If the Outcome Period has begun and the Fund has increased in value to a level near to the Cap, an investor purchasing at that price has little or no ability to achieve gains but remains vulnerable to downside risks. Additionally, the Cap may rise or fall from one Outcome Period to the next. The Cap, and the Fund's position relative to it, should be considered before investing in the Fund. The Funds' website, www.innovatoretfs.com, provides important Fund information as well information relating to the potential outcomes of an investment in a Fund on a daily basis.

The Funds only seek to provide shareholders that hold shares for the entire Outcome Period with their respective buffer level against reference asset losses during the Outcome Period. You will bear all reference asset losses exceeding the buffer. Depending upon market conditions at the time of purchase, a shareholder that purchases shares after the Outcome Period has begun may also lose their entire investment. For instance, if the Outcome Period has begun and the Fund has decreased in value beyond the pre-determined buffer, an investor purchasing shares at that price may not benefit from the buffer. Similarly, if the Outcome Period has begun and the Fund has increased in value, an investor purchasing shares at that price may not benefit from the buffer until the Fund's value has decreased to its value at the commencement of the Outcome Period.

The Funds' investment objectives, risks, charges and expenses should be considered carefully before investing. The prospectus contains this and other important information, and it may be obtained at innovatoretfs.com. Read it carefully before investing.

Innovator ETFs are distributed by Foreside Fund Services, LLC.