May 1, 2024

Which Asset Class Can Inflation Proof Your Portfolio?

Tom O'Shea, CFA

Director of Investment Strategy

Innovator Capital Management

As inflation readings remain stubbornly high, and officials seem comfortable with keeping rates at restrictive levels for longer, investors need to consider how best to protect the value of their assets. Arguments can be made for the inflation-resistant properties of various asset classes, but it's imperative for investors to carefully weigh the advantages and disadvantages of each asset class before making allocation decisions.

How did we get here?

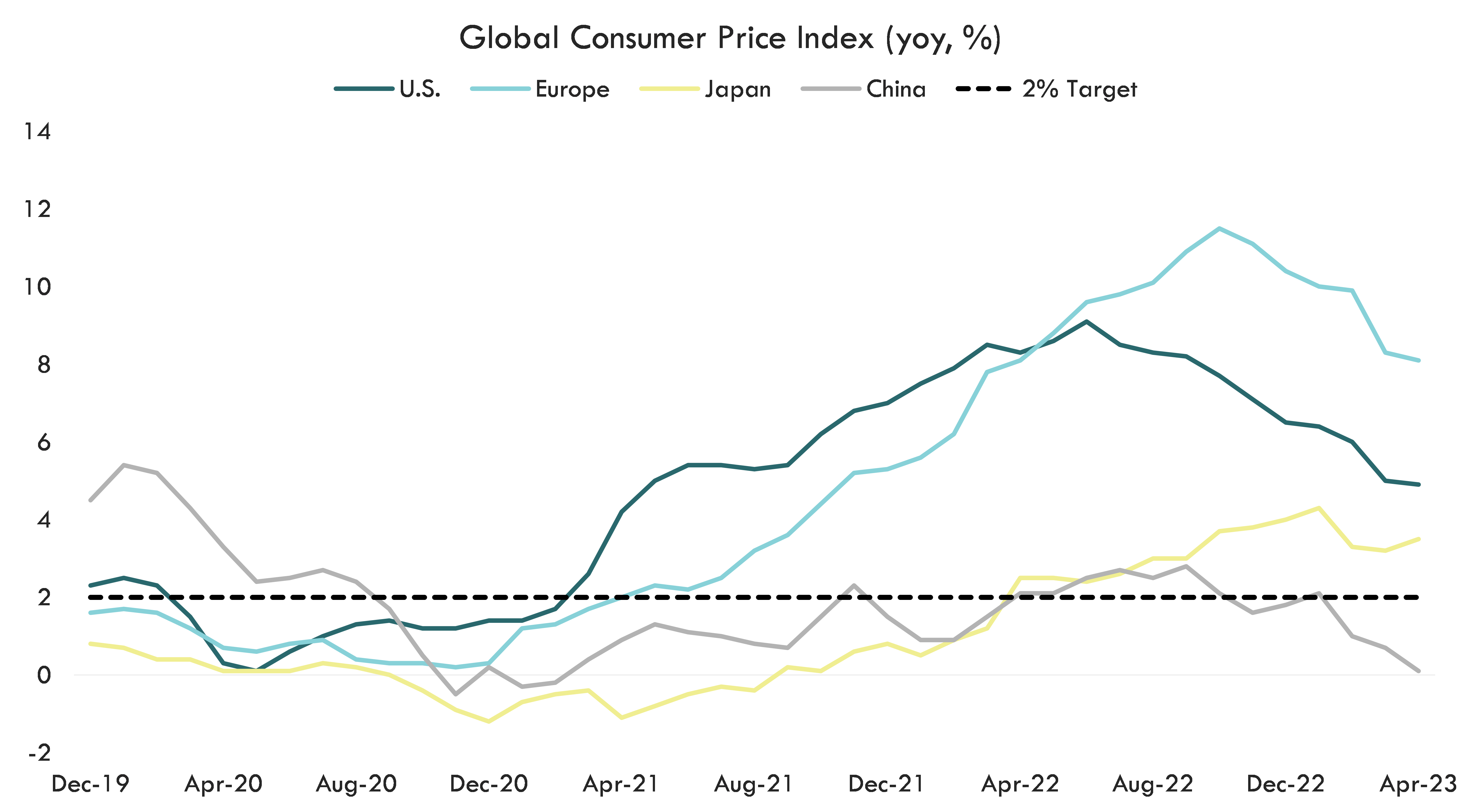

Covid-19 led to closed economies, job loss, and demand destruction globally. Demand fell so much that WTI crude oil futures actually traded negative and Consumer Price Indices dropped across the globe. In response to the slowing growth picture, global central banks implemented extraordinary measures, slashing interest rates to zero and expanding their balance sheets. Governments stepped up as well, showering the world with stimulus packages. In retrospect, governments and central banks used a sledgehammer to crack a nut.

Source: Bloomberg, Innovator Research & Investment Strategy. Monthly data from 12/31/2019 - 4/30/2023.

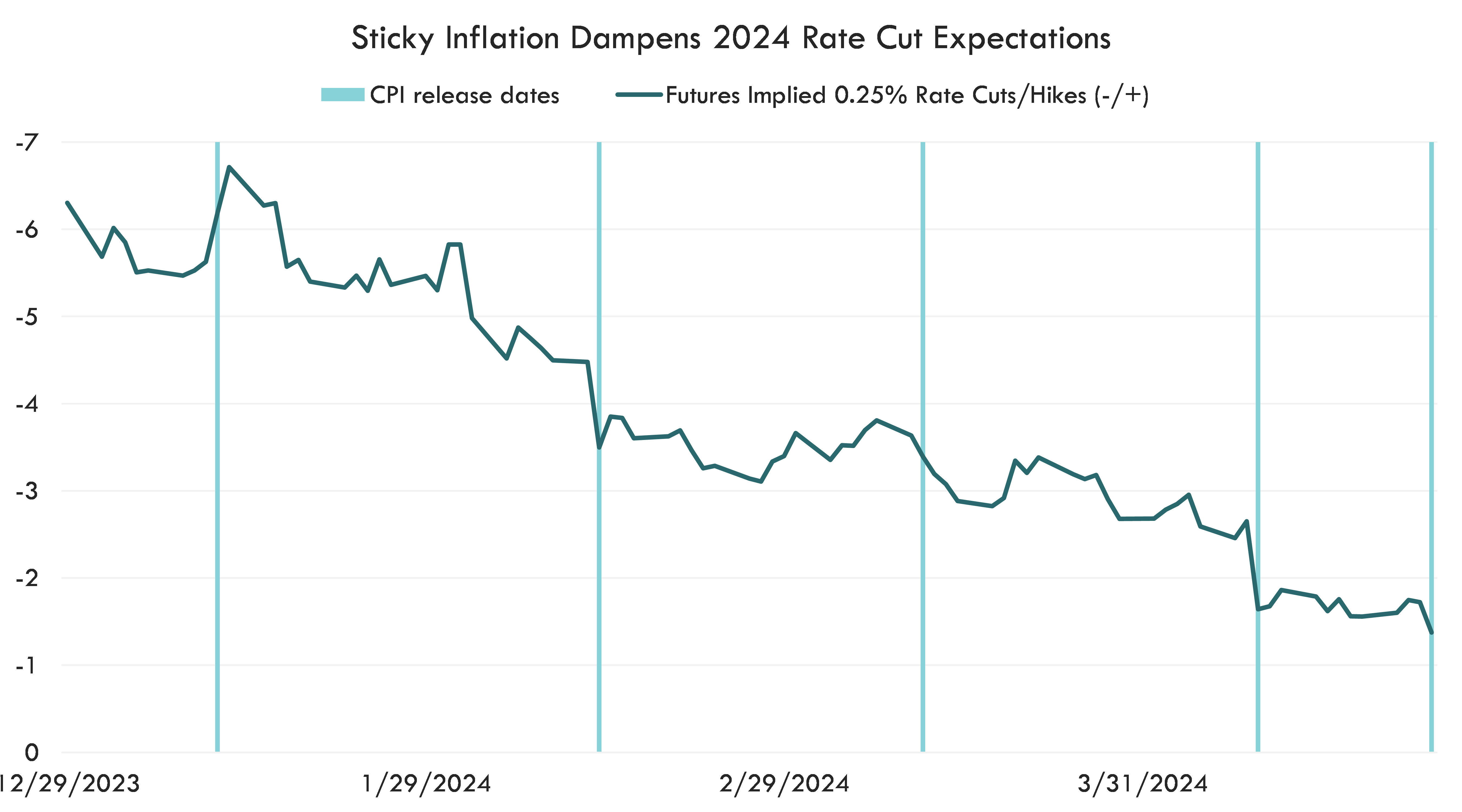

Inflation surged to levels unseen since the early 1980s, prompting a hawkish response from the Fed. Over the ensuing 17 months, the Fed Funds rate was raised aggressively to 5.5%, triggering significant losses across global equities and fixed income markets in 2022 as investors braced for prolonged restrictive monetary policy. Consumer prices fell on 11 consecutive reports from May 2022 to June 2023, driving a strong recovery across the majority of asset classes. By the end of the year, Fed Chair Jerome Powell had seemingly declared victory over inflation and stated the central bank’s intentions to cut rates in 2024, perhaps as early as March. Initially, market participants anticipated six cuts by year end, but since Powell’s comments, we have seen four hot CPI reports. Now rate cut expectations have dwindled to only one, with some strategists suggesting additional hikes to prevent a resurgence in inflation. In the event of rising consumer prices, many investors consider which asset classes will best serve them.

Source: Bloomberg, Innovator Research & Investment Strategy. Data from 12/31/2023 - 4/25/2024.

Tale of the Tape

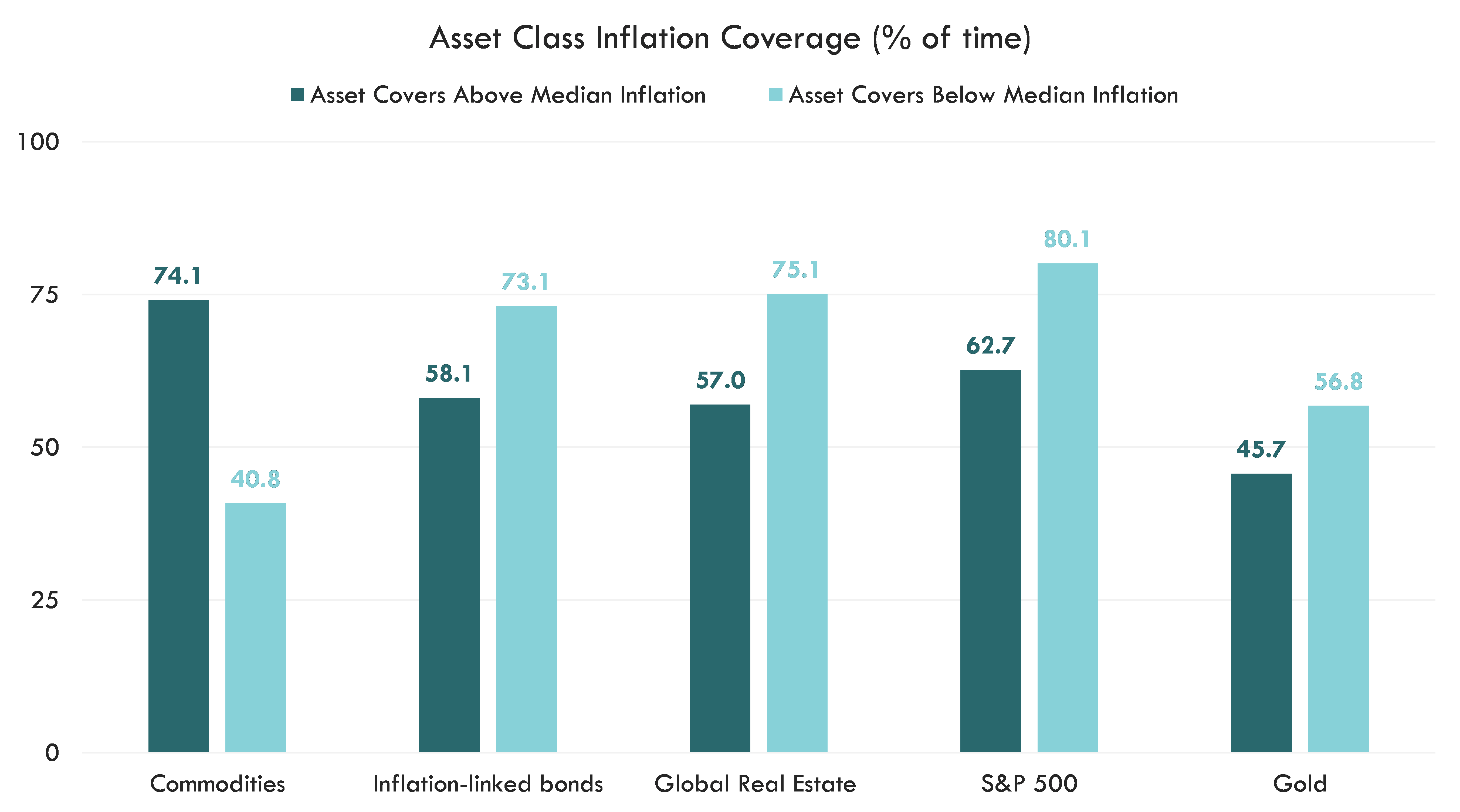

When investors contemplate strategies to hedge against both anticipated and unforeseen inflation, several major asset classes typically spring to mind: Inflation-indexed bonds, commodities, gold, real estate, and stocks.

At first glance, all of these asset classes, with the exception of gold, exhibit coverage of above-median inflation more than 50% of the time. We measure this by comparing rolling 1-year returns against the median inflation figure of 2.9% going back to 1950. Notably, commodities and U.S. equities have demonstrated the most robust coverage in high inflation scenarios, with rates of 74% and 62%, respectively. That said, it’s worth examining each asset class carefully and determining the optimal allocation strategy for the investor’s individual portfolio.

Source: Bloomberg, Innovator Research & Investment Strategy. Monthly data through 3/31/2023. Commodities = Bloomberg Commodity index (1/31/1970 start), Inflation-linked bonds = Bloomberg US Treasury Inflation Notes TR Index (3/31/1997 start), Global Real Estate = S&P Global REIT USD Total Return Index (5/31/1989 start). S&P 500 (1/31/1928 start), Gold (1/31/1975 start). Median year-over-year inflation of 2.9% is measured by the Consumer Price index starting in 12/31/1950. Past performance does not guarantee future results.

Commodities

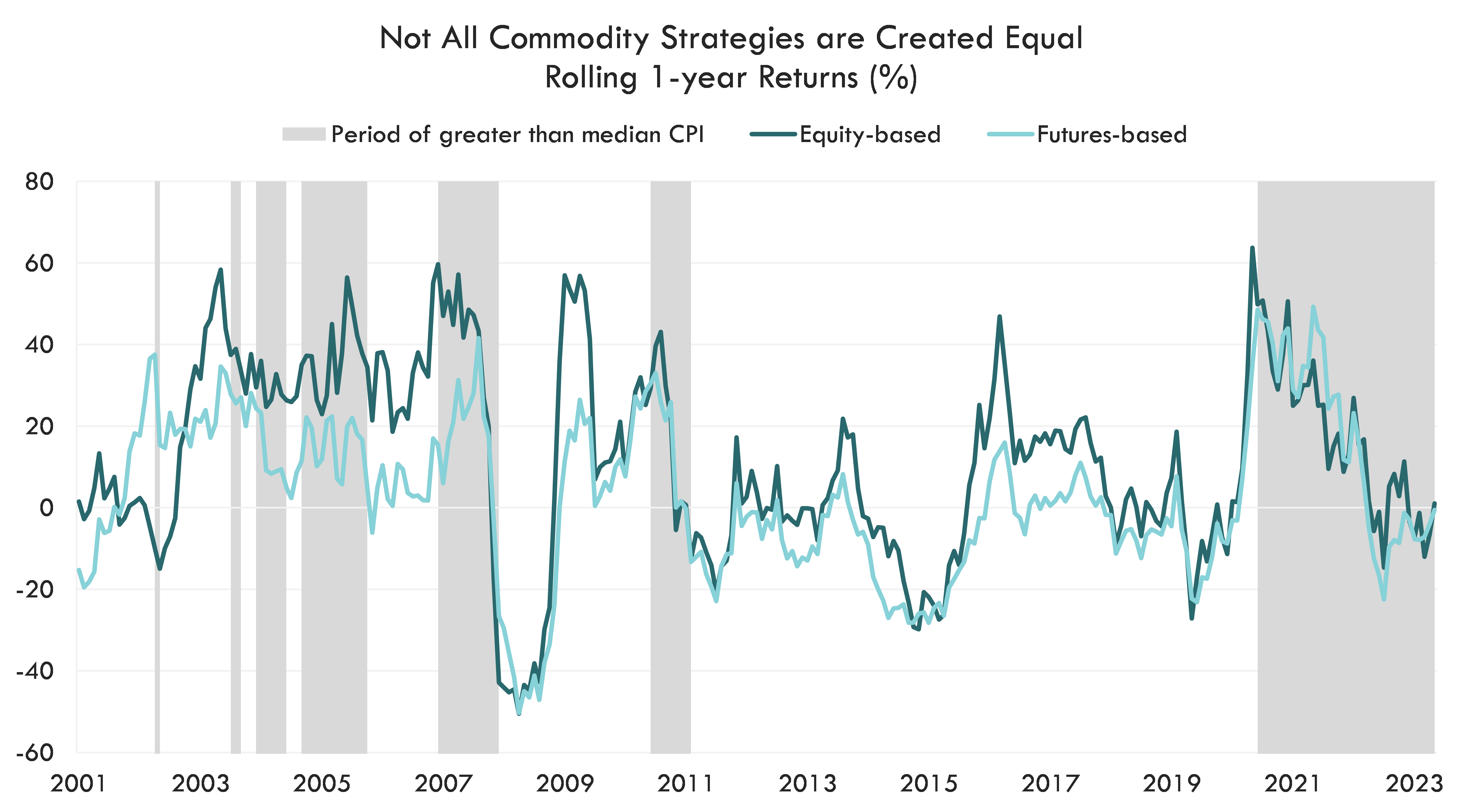

Commodities led all major asset classes in terms of above-median inflation coverage, exceeding the next closest class by over 10%. However, the below-median inflation coverage stands out as a glaring weakness that may dampen portfolio returns. 2022 showcased the evident advantage for investors diversified with commodities. While U.S. equities and bonds posted double digit negative losses, the Bloomberg Commodity Index returned an admirable 16.1%. But once disinflation occurred, the performance of those asset classes flipped and commodities declined by 8% in 2023. Investment strategies centered around commodities often rely on futures, forwards, or swap contracts. Although these contracts may pay off during periods of rising prices, the periodic rolling of these contracts could elevate costs enough to weigh on portfolio returns when commodity prices stabilize or fall.

Investors looking for protection may be better served investing in equity-based commodities. Rather than owning derivative contracts for commodity exposure, equity-based commodity vehicles own companies that create, hold, and transport commodities. Since the asset class’s common inception at the turn of the century, these forms of commodity exposures have been highly correlated. However, equity-based commodities have demonstrated a notable edge, consistently outperforming not only during periods of high inflation but also during prolonged stretches of low inflation. The potential for commodities to cover anticipated and unexpected inflation warrants a small strategic holding. Investors should carefully consider implementation strategies so they do not lag in low-inflation environments.

Source: Bloomberg, Innovator Research & Investment Strategy. Data from 11/30/2000 - 3/31/2024. Equity-based = Morningstar Global Upstream Natural Resources Index. Futures-based = Bloomberg Commodity Index. Past Performance does not guarantee future results.

Inflation-linked bonds

Inflation-linked bonds, such as Treasury inflation-protected securities (TIPS), are usually government bonds that offer investors a fixed rate while adjusting the principal value of the bonds in accordance with changes in consumer prices. The principal reset has historically allowed TIPS to effectively hedge inflation in the majority of market scenarios. Dating back to 1997, TIPS have an impeccable record of covering inflation during low-inflation periods at about 75%. However, during times of high inflation, although still robust, TIPS exhibit a slightly lower coverage rate of around 60%. The drop off can be attributed to the interest rate sensitivity of the asset class. As a fixed-income instrument, the asset price moves inversely to interest rates. Consequently, rising interest rates result in declining TIPS prices. The accompanying chart demonstrates TIPS’ ability to cover inflation the majority of the time between 1% - 5% inflation. However, when inflation exceeds 5%, the price decline in TIPS, due to higher rates, may occur more rapidly than the adjustment of principal to inflation. TIPS can also hurt portfolio returns during CPI price growth of around 1% or less due a downward adjustment in the principal. Overall, the performance of inflation-linked bonds during periods of elevated prices warrants a strategic holding in investors’ risk control portfolio.

Source: Bloomberg, Innovator Research & Investment Strategy. Rolling 1-year data from 3/31/1997 - 3/31/2024. Bubble size represents the magnitude of return. Past performance does not guarantee future results.

Real Estate

Real estate companies and real estate investment trusts (REITs) often thrive amid rising consumer prices. Generally, heightened inflation allows managers to raise tenant rents, leading to greater income generation and higher property values which can fortify portfolios against decaying purchasing power. Similar to TIPS, real estate holdings may suffer during periods of rapidly rising rates. Investor demand may decrease as ownership costs escalate. Historically, global real estate covers inflation at a similar clip to TIPS but does so with significantly more volatility. While TIPS investors rely on the U.S. government for returns, real estate investors confront various idiosyncratic risks. The higher volatility in real estate reflects location-specific risk, demand fluctuations, property deterioration, regulatory and legal uncertainties, as well as liquidity risks. Despite real estate's track record of covering inflation, investors must meticulously assess the associated risks before proceeding with an allocation.

Source: Bloomberg, Innovator Research & Investment Strategy. Data from 4/14/1998 - 3/31/2024. TIPS = Bloomberg US Treasury Inflation Notes Index. Global Real Estate = S&P Global REIT USD Index. Past performance does not guarantee future results.

S&P 500

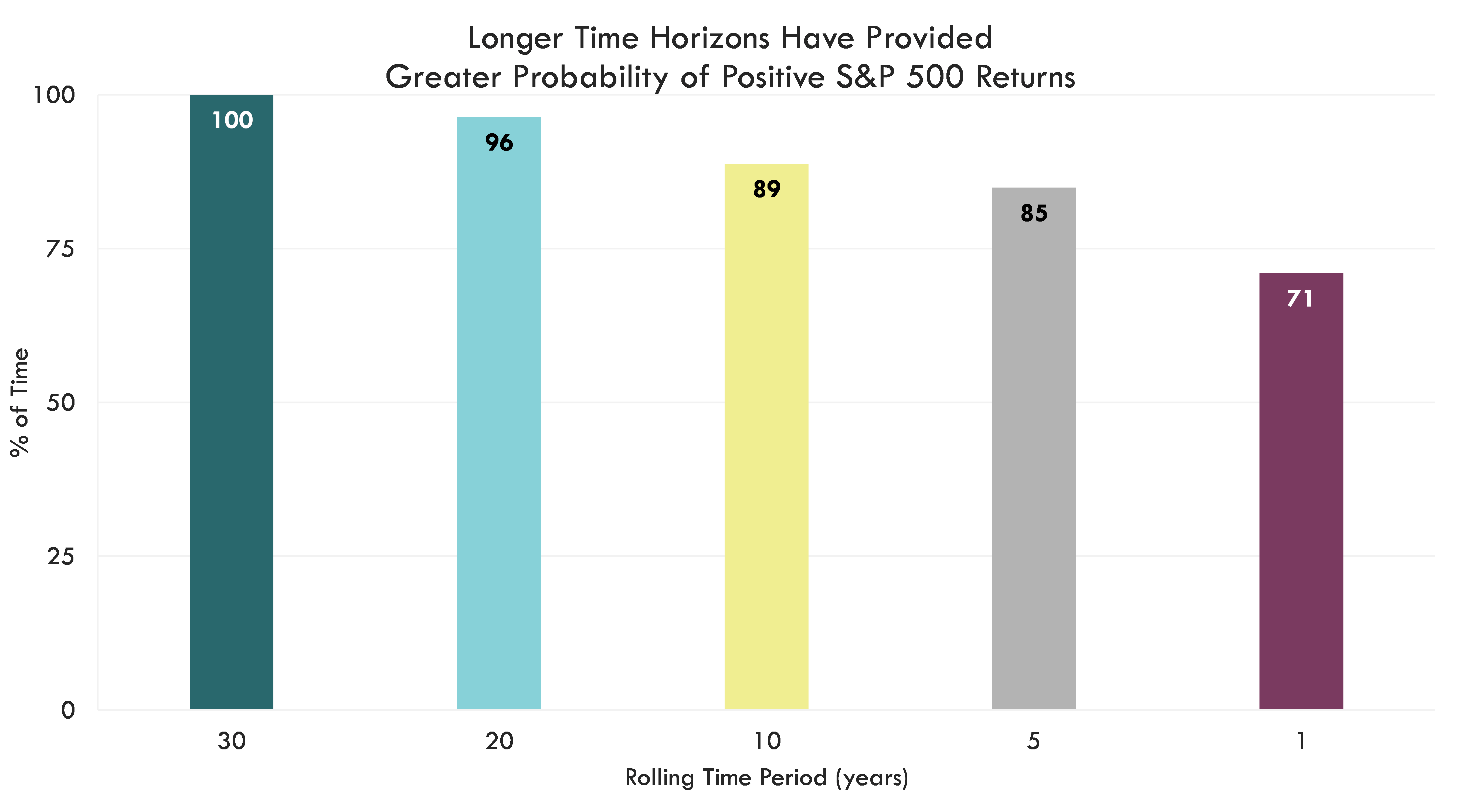

The S&P 500 often forms the cornerstone of many investors' portfolios, representing a core growth vehicle that offers the potential for both capital appreciation and dividend income. Investors with long time horizons have benefitted from increasingly favorable odds of earning a positive return. Looking back to 1928, investing over any 1-year time period has provided a 71% chance of earning a positive return while all 30-year periods have yielded positive returns. Unfortunately, not all investors have the luxury of a lengthy time horizon. An investor needing liquidity at the end of 2022 would not only have failed to cover inflation, they would have dug an 18% hole in their portfolio that might not have allowed them to meet liquidity needs.

Source: Bloomberg, Innovator Research & Investment Strategy. Rolling returns from 12/31/1928 - 3/31/2024. Past performance does not guarantee future results.

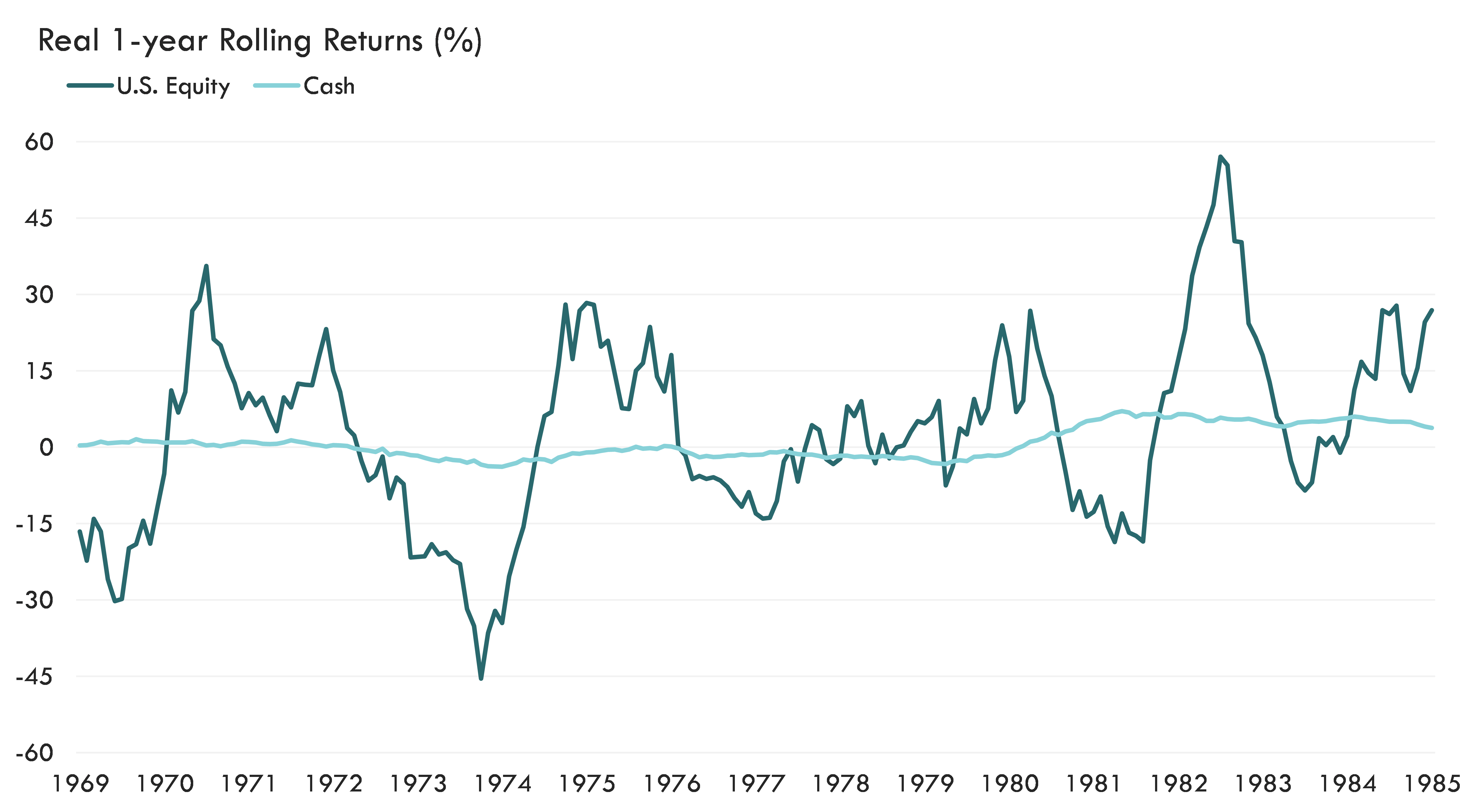

The elevated inflation period spanning the 1970s to the early 1980s serves as a stark reminder of the danger associated with a substantial equity allocation coupled with a short time horizon. In the illustration below, we compare rolling 1-year returns of real cash and real S&P 500. It reveals numerous instances where the robust returns generated by short-term cash holdings were insufficient in keeping pace with the rapid rise in prices. While the S&P 500 exhibits significant outperformance against inflation over longer periods, it also experiences notable underperformance during certain one-year intervals. An equity allocation remains one of the most effective strategies to maintain purchasing power over time. However, investors with shorter time frames should consider diversification with other asset classes.

Source: Bloomberg, Innovator Research & Investment Strategy. Rolling 1-year return data from 12/31/1968 - 12/31/1985. Real U.S. Equity is proxied by S&P 500 return minus headline CPI (y/y). Real cash = Ibbotson 30-day T-bill index less headline CPI (y/y). Past performance does not guarantee future results. Once cannot invest directly in an index.

Gold

Market participants have historically allocated to gold as a means of storing value, in part, because it is not directly tied to any government or currency which theoretically would make it unaffected by changing inflation. In terms of inflation coverage, it has performed the worst out of the major asset classes when consumer prices rise above median. While gold may have a place in some portfolios as a diversification tool, excessive allocation could hinder long-term performance. Unlike many of the investments discussed above, gold does not generate any income or dividends. Additional considerations such as the storage and insurance costs can also erode returns. While gold may offer certain benefits as an uncorrelated asset class, prudent investors will consider its limitations and associated costs before including it in portfolios.

Bottom Line

As 2024 progresses, we expect fiscal stimulus and robust consumer spending to challenge the Fed in reaching its target inflation level. In preparation for a period of increasing consumer prices, market participants need to protect the purchasing power of their portfolios while simultaneously managing downside risks. Beyond the assets already examined, investors could explore strategies that provide hedged exposure to equities.

This material contains the current research and opinions of its author, which are subject to change without notice. This material is not a recommendation to participate in any particular trading strategy and does not constitute an offer or solicitation to purchase any investment product. Unless expressly stated to the contrary, the opinions, interpretations, and findings herein do not necessarily represent the views of Innovator Capital Management, LLC (“Innovator”) or any of its affiliates.

This material is provided for informational purposes only. References to specific securities in this material are provided for informational purposes only and do not constitute a recommendation for any security. Readers should consult with their investment and tax advisers to obtain investment advice and should not rely upon information published by Innovator or any of its affiliates. Past performance does not guarantee future results. The information herein represents an evaluation of market conditions as of the date of publishing, is subject to change, and is not intended to be a forecast of investment outcomes.

Certain information herein contains forward-looking statements such as "will," "may," "should," "expect," "target," "anticipate," or other variations of these statements. Forward-looking statements are based upon assumptions which may not occur, while other conditions not taken into account may occur. Actual events or results may differ materially from those contemplated in such forward-looking statements.