August 29, 2023

Using a 15% Buffer Strategy to Increase Equity Exposure

Erik Abrell

Research Analyst

Innovator Capital Management

It is often said that the equity market is the greatest generator of wealth. While this may be true, not everyone can take on the full risk the equity market offers. Everyone has varying investment objectives, time horizons, and capacity to stomach volatility. As a result, many investors use bonds to diversify away risk in exchange for lower returns. However, we believe there is a better way to achieve risk management, while also increasing equity exposure. In the following commentary, we argue the benefits of having greater equity exposure and why investors should consider a 15% buffer strategy as a complement or replacement to a traditional fixed-income allocation.

Tying Low-Risk Dollars to the Equity Market

Many investors consider bonds lower risk because their volatility has historically been lower than equities. However, investors are still exposed to interest rate, inflation, and credit risk when investing in fixed income securities. The uncertainty of the bond market, combined with the limited return potential, make a case for investors to look else for risk management. We believe there is a better way to invest low-risk dollars – by providing a known downside buffer and known upside return potential.

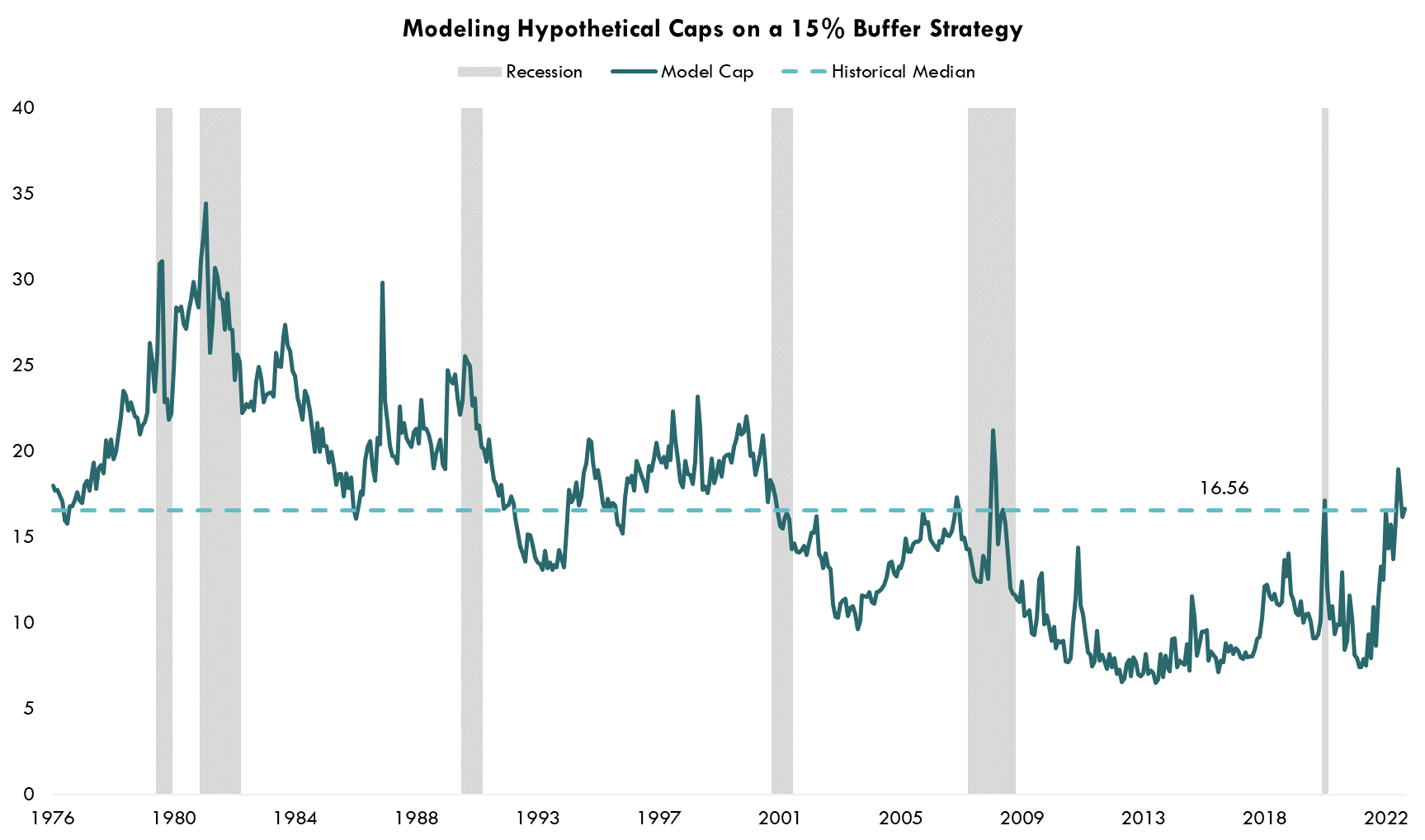

To demonstrate the power of tying low-risk dollars to the equity market, our Research and Investment Strategy team modeled out historical caps for a 15% buffer strategy, dating back to 1976, by using an options pricing model to illustrate the potential upside the strategy holds. Historically, the 15% buffer strategy benefitted from higher market volatility as the options premium is more expensive, creating a higher cap. Looking at the data since 1976, the median cap would have been 16.54%, hitting as high as 34% in September of 1981.

Source: Bloomberg, Innovator Research & Investment Strategy. Model caps are based on a regression analysis of CBOE’s volatility index, the 2-year treasury yield, and volatility of the S&P 500 the week before a cap reset. These coefficients are modeled from 6/30/1976 – 12/31/2022.

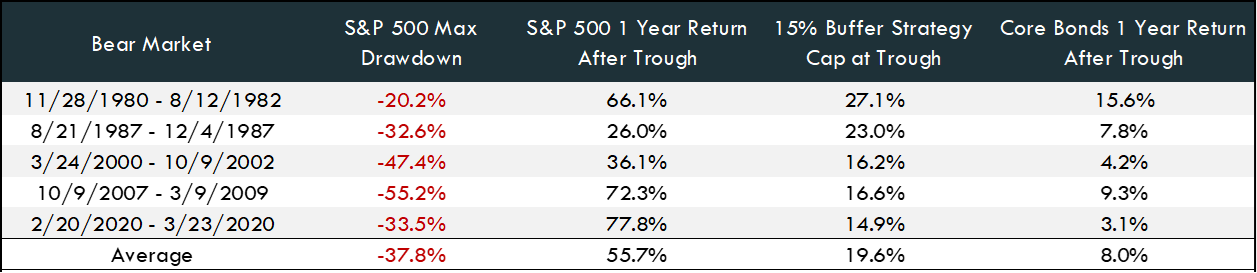

Fear Drives Investors Out of Equities at the Wrong Time

Times of high market volatility typically make investors fearful, and thus more likely to move out of the equity market and into cash or bonds. By selling out of equities and moving into bonds, the investor is likely to miss out on a portion of market rebounds, resulting in a missed opportunity for their portfolio to appreciate on the best days in the market. As an example, one year post the 1987 bear market, core bonds returned 7.8%. Meanwhile the equity market rallied 26% in that year. At that time, the modeled cap was roughly 23%. By selling equities and going into bonds, an investor would have missed out on a sizeable rebound.

15% Buffer Strategy in Context

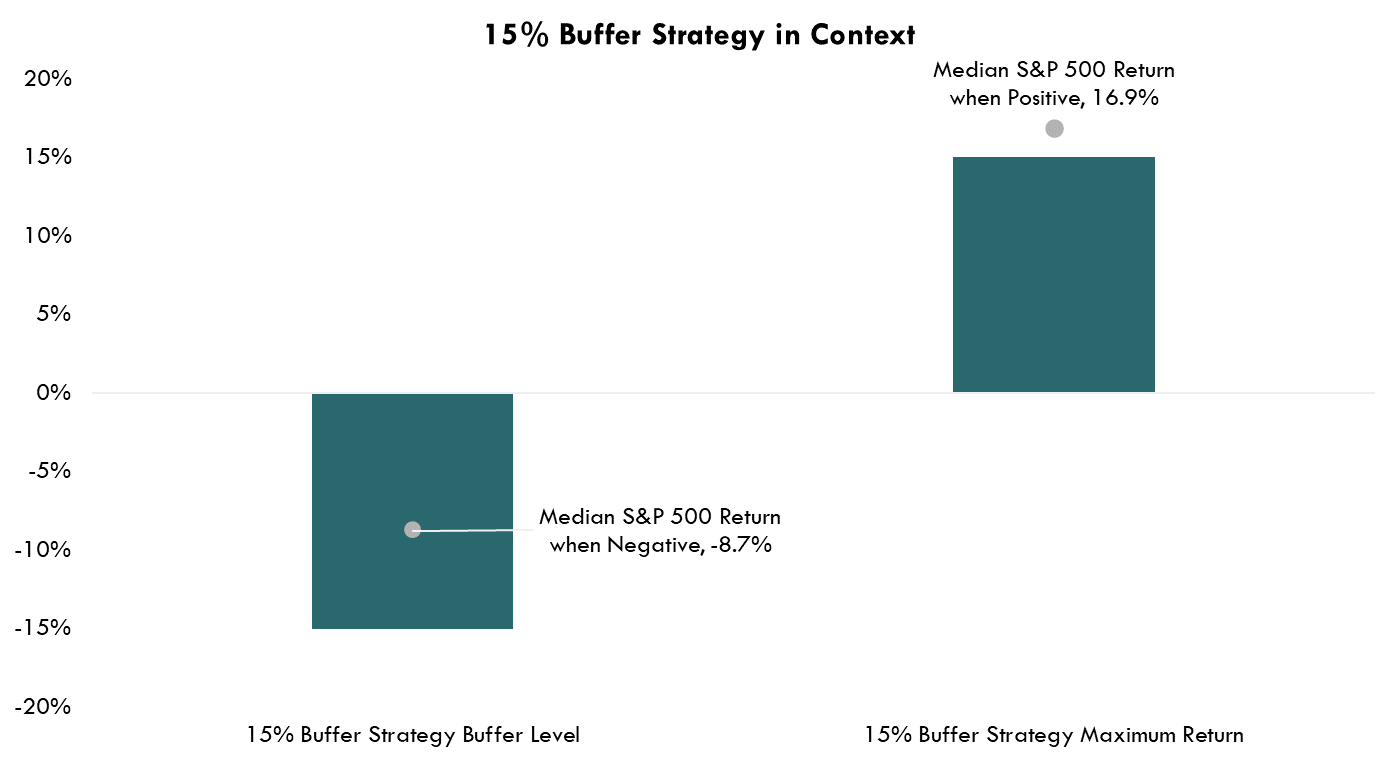

Investors are rethinking the traditional asset allocation. While a buffered equity allocation has never had a negative correlation to the equity market, over the long-term, investors may have an advantage allocating to a 15% buffer strategy. The 15% buffer strategy is designed to allow investors to participate meaningfully in market rallies, to a cap, while having a known downside buffer over each outcome period should the market fall. On a 1-year return basis, dating back to 1950, when positive, the median S&P 500 return is 16.9%. On the flip side, when the market is negative it has a median return of -8.7%. A 15% buffer strategy, assuming a cap of 15% each outcome period, could realize the full 15% return in a typical positive S&P 500 market. In a typical negative S&P 500 environment, the strategy would fully buffer investors from the -8.7% return.

Source: Bloomberg LP, SPX Index, as of 12/31/1949 – 7/31/2023

There are times when a 15% buffer strategy does not fully mitigate S&P 500 losses (when the S&P 500 is below 15% over the outcome period). Bonds on the other hand, may fully dampen a draw down and even deliver a positive total return throughout a market drawdown. Unfortunately, as we saw in 2022, the negative correlation benefits do not always work as intended.

A 15% Buffer Strategy may be beneficial over the long run, offering some risk mitigation greater participation throughout market rebounds, allowing investors to stay cautiously invested in the throughout market drawdowns, and rebounds, when uncertainty is high. This may result in a total return bonds are able to produce.

The table below illustrates the power of staying invested in the equity market despite severe drawdowns. Looking at the last five bear markets, the 15% buffer strategy cap at trough averaged around 20%; meaningfully higher than core bond returns. This means when the market rebounded, the 15% buffer strategy would have been capped out in every scenario, doubling or tripling the returns of core bonds in the short, 1-year time frame. This highlights the power of tying low-risk dollars to the equity market, as investors who moved to bonds would have missed out on these rebounds.

Source: Bloomberg LP, SPX Index, LBUSTRUU Index, Total return as of 11/28/1980 – 8/12/1982, 8/21/1987 – 12/4/1987, 3/24/2000 – 10/9/2022, 10/9/2007 – 3/9/2009, 2/20/2020 – 3/23/2020, 15% Buffer Strategy Cap as of Innovator Research & Investment Strategy

Positioning the Portfolio

The 15% buffer strategy can be a versatile addition to a portfolio. Depending on the investor’s risk tolerance and other goals, the 15% buffer strategy should be considered for the equity and fixed income sleeve of a portfolio. However, when complementing or replacing a portion of the fixed income holdings, the strategy has the ability to enhance returns and provide a buffer to help manage risk.