July 20, 2023

When Cash Isn't King

Tom O'Shea, CFA

Director of Investment Strategy

Innovator Capital Management

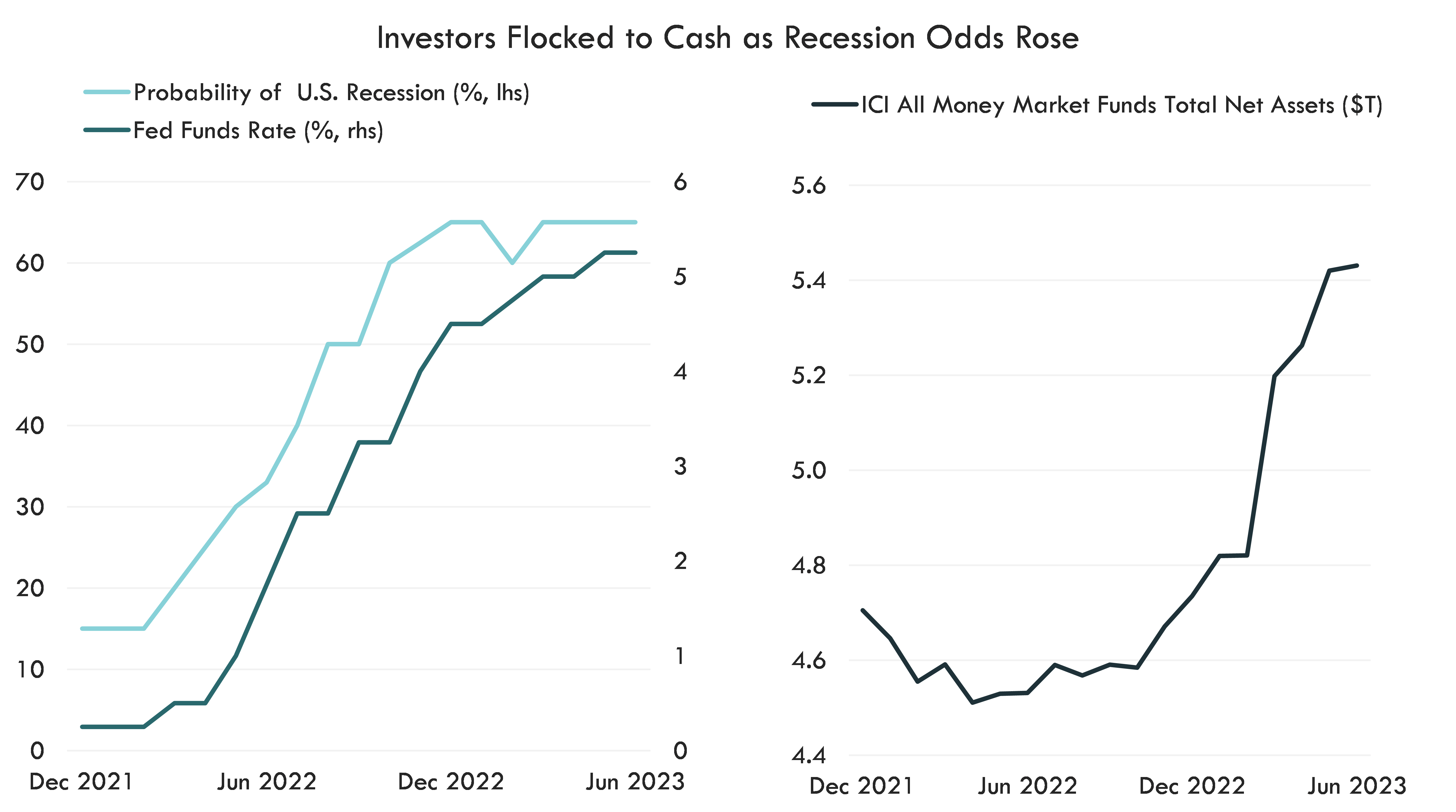

At the beginning of 2022, central bankers began their fight against heightened inflation with a higher Fed funds rate and quantitative tightening. As the main policy rate trekked higher, economists expected the long and variable lags of monetary policy to weigh on economic growth. As a result, they raised their expectations of a recession hitting the U.S. within the next 12-months. Rate increases and the higher odds of recession made cash and other short-term alternatives attractive. While cash and cash alternatives offer liquidity and risk management, placing too much in a portfolio may weigh on performance.

Source: Bloomberg, Innovator Research and Investment Strategy. Monthly data from 12/31/2021 - 6/30/2023.

Too Much Cash Can Be a Drag

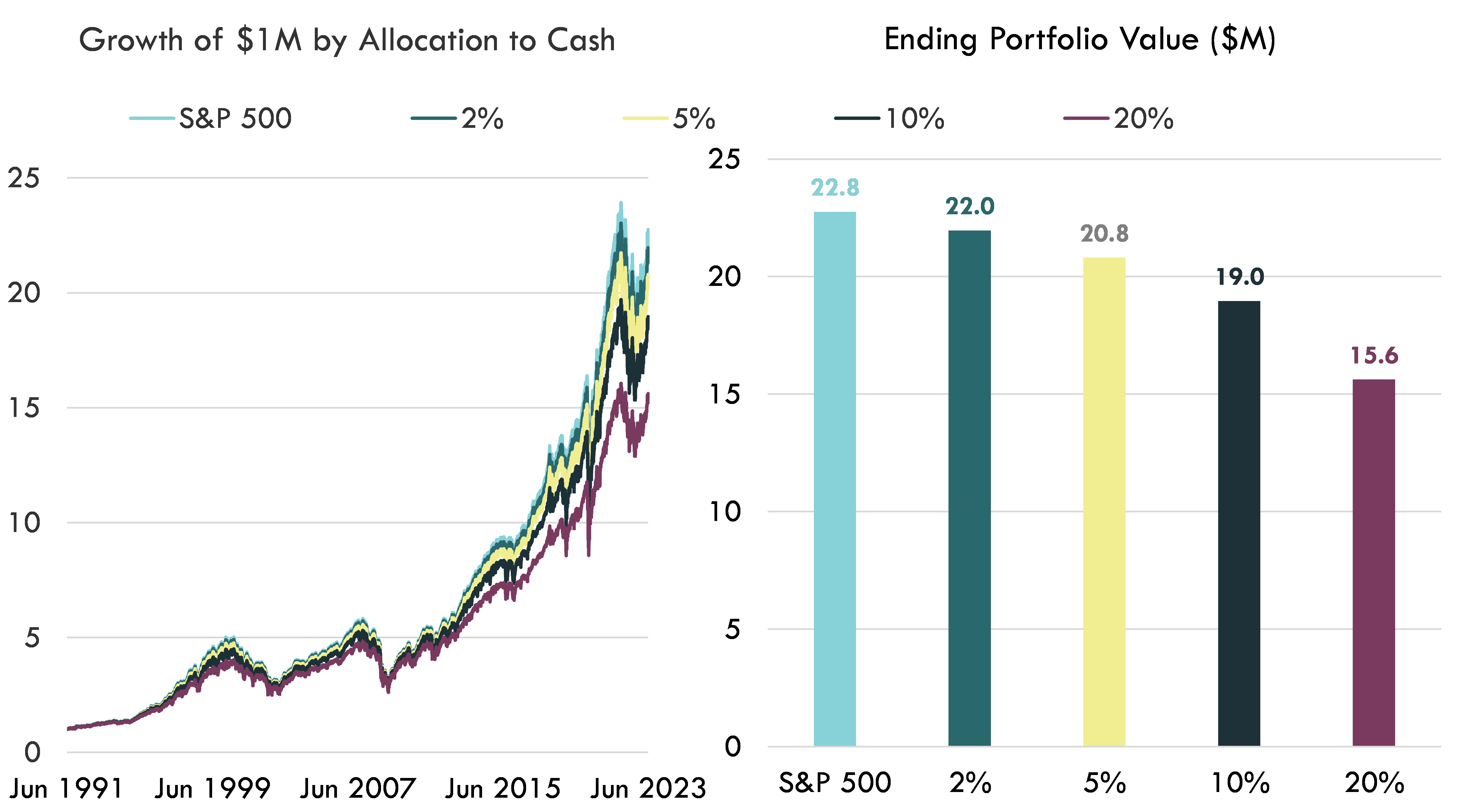

Cash allocations increased with rising rates and turbulent markets in 2022. Regardless of market environment, allocations of 2% to 20% are common among investors depending on liquidity needs and risk tolerance. Unfortunately, the larger the allocation to cash, the more an investor’s portfolio will likely lag the market in up scenarios. Economists' recession probabilities initially increased over 60% in October 2022, coinciding with the S&P 500 bottom. Since the market bottom, the recession probability has remained above 60% while U.S. equities have shot up more than 25%. The mismatch in recession odds and actual equity performance illustrates the difficulty in market timing and why we believe it’s important to maximize equity exposure.

The chart below demonstrates how cash allocations can detract from long-term portfolio gains. From 1991 to 2023, a 2% cash allocation in a $1 million portfolio would leave an investor with $800,000 less than a fully invested portfolio. Increasing the cash allocation to 20% would leave an investor with about $7 million less.

Source: Bloomberg, Innovator Research & Investment Strategy. Daily data from 6/29/1991 - 6/30/2023. Cash allocation represented by Bloomberg US Treasury Bills Index. Past performance does not guarantee future results.

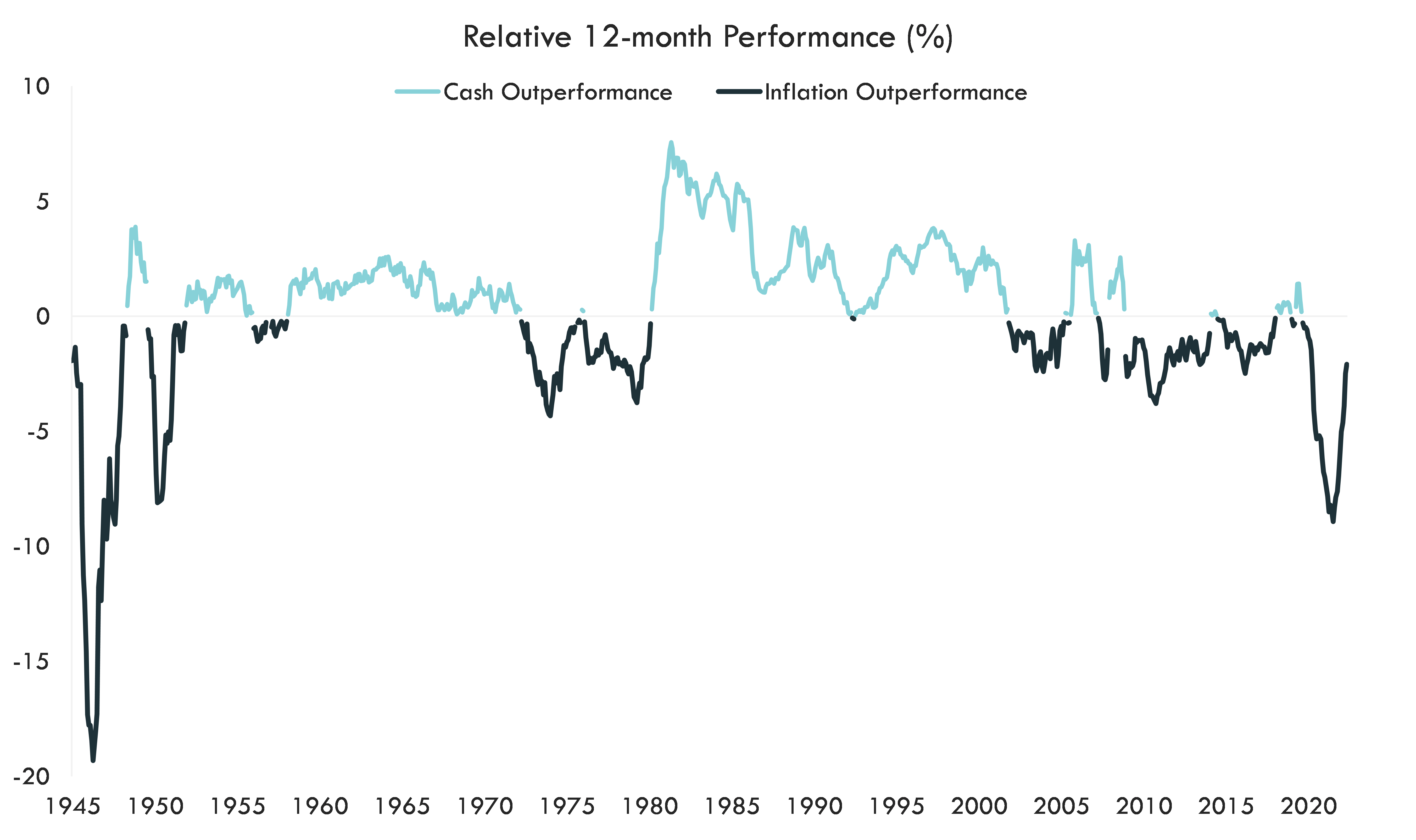

The Hidden Cost of Inflation and Taxes

Cash undoubtably provides liquidity and manages risk during volatile markets. From a behavioral finance perspective, investors may find comfort in being able to log into their bank accounts and the dollar value will not decline unless they remove money. The dollar value may even increase during periods of high interest rates. However, many investors fail to factor in inflation which can silently erode investor purchasing power. Your bank account value remains stable while grocery prices, travel, dining, and entertainment prices creep higher. Investors experienced this cash value erosion over long periods immediately after World War 2, the 1970s, and majority of the time after the year 2000.

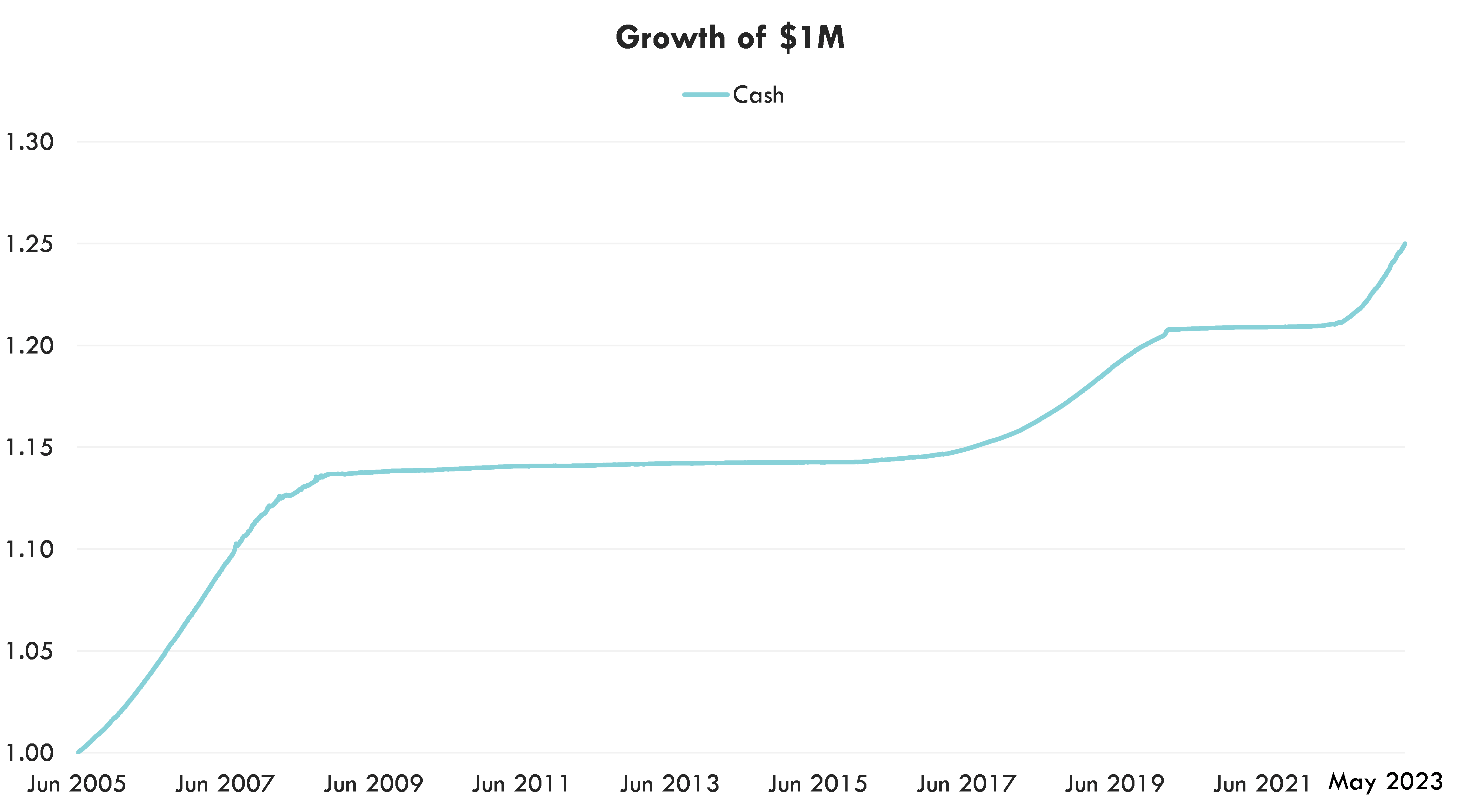

Source: Bloomberg, Innovator Research & Investment Strategy. Data from 6/30/2005-5/31/2023. Cash = Bloomberg U.S. Treasury Bills 1-3 Month Index. Past performance does not guarantee future results.

Interest income generated in banks or money market accounts was minimal for long periods in the past 20 years. We can see a lack of cash growth in the Zero Interest Rate Policy period following the Global Financial Crisis and immediately after the Covid 19 crisis when the Fed, once again dropped rates to zero. Fast forward to 2022 and the monetary policy tightening spree that drove interest rates higher left many investors pleasantly surprised seeing interest growing in their accounts. Unfortunately, the IRS requires account holders to pay ordinary income tax on this interest income, with the highest rate currently at 37%. Taxes are another commonly overlooked aspect that can detract from a portfolio’s growth.

Source: Bloomberg, Innovator Research & Investment Strategy. Data from 6/30/2005-5/31/2023. Cash = Bloomberg U.S. Treasury Bills 1-3 Month Index. Past performance does not guarantee future results.

Bottom Line

The strength of consumer spending and the labor market is causing economists to keep kicking recession forecasts down the road. While investors wait for the recession with their large cash holdings, they may be susceptible to a cash drag, inflation erosion, and paying unwanted taxes next year. To combat some of the negatives of holding cash, we feel prudent investors should consider diversifying their cash holdings with buffered equity strategies.

The S&P 500® is an index representing large-cap U.S. equities