April 1, 2022

A Big Move but More to Come

Tim Urbanowicz, CFA

Head of Research & Investment Strategy

Innovator Capital Management

Since late last year, we have been arguing that investors need to look beyond traditional fixed income to help manage risk, as bonds are unlikely to provide the returns, diversification, or protection they have in the past. Below, we explore three reasons why, even after a spike in yields, we believe the risk reward tradeoff remains unfavorable for bonds, and why a new cycle may call for new strategies to help manage risk.

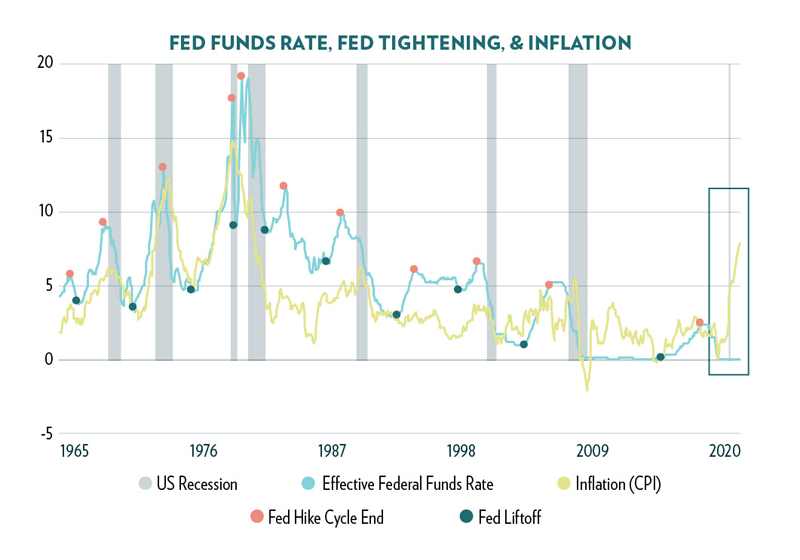

The Risk of an Aggressive Fed Remains High

The Fed began its tightening cycle in March off the lowest policy rate in history and with inflation at a 40 year high. As shown below, the gap between U.S. Consumer Price Index (CPI) and the Fed Funds rate stands at around +7.5%, substantially higher than at any point over the last 50+ years. For context, the average gap between the two historically has been around -1%. More evidence that the Fed is likely behind the curve and will need to move faster to get inflation under control, increasing the odds of a policy induced recession. Even Powell now acknowledges that a soft landing will not be easy. Since 1965, the Fed has never begun a hike cycle with inflation this high and avoided a recession (see dots and recession bars below). This is not a comforting backdrop for investors that need to manage this risk and recognize the challenges higher rates present for bonds.

Source Bloomberg LP, US Consumer Price Index % Change YoY, Effective Federal Funds Rate, Goldman Sachs Global Investment Research, Data from 12/31/1965-2/28/2022. Past performance does not guarantee future results

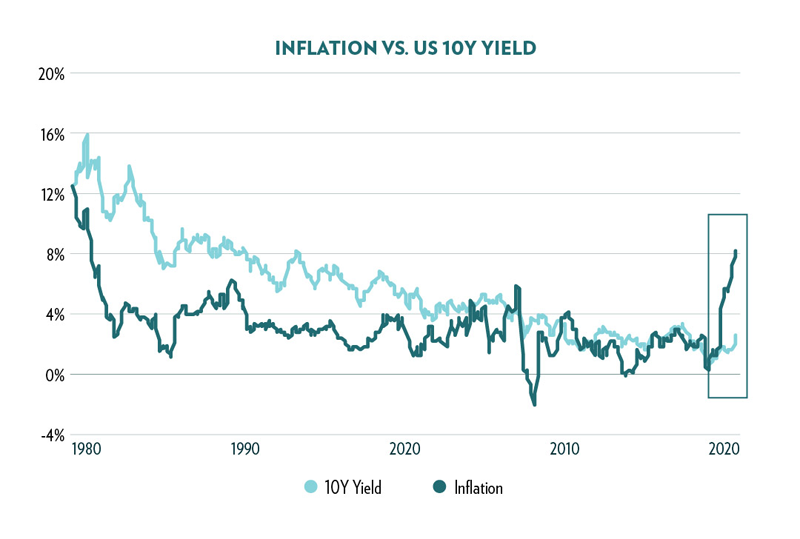

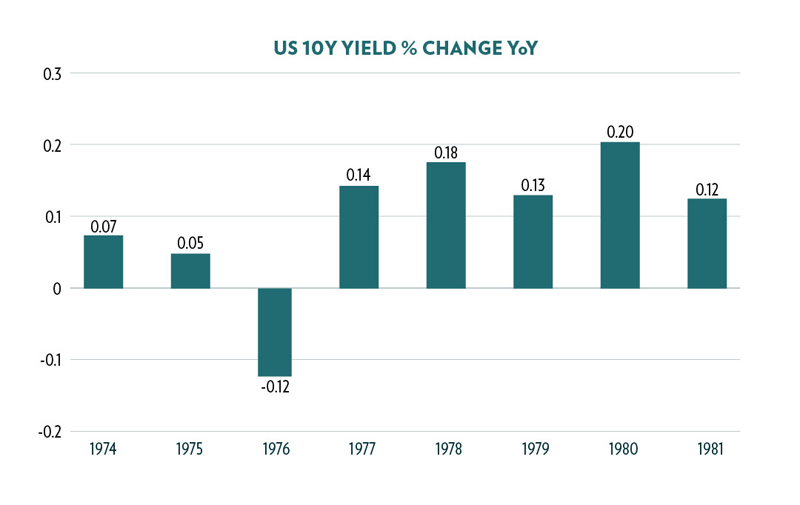

Yields Have Made a Big Move... But They are Still Disconnected

Interest rates have made a big move this year, starting at 1.5% in January, jumping up to 2.5%. Although this 66% increase is a rapid move, in the broader context, rates are still severely depressed and completely disconnected from inflation (see chart below). The last time inflation was this high, it was throughout the stagflationary 1970s and early ‘80’s. During this time, the 10-year treasury yield saw numerous increases, moving from 6.9% at the end of ’73 to 14% at the end of 1981. Well over a 100% jump. I believe it could take time to get inflation down to a reasonable level, leaving a longer runway for rates than some might expect.

Source Bloomberg LP, US Consumer Price Index % Change YoY, Effective Federal Funds Rate, Goldman Sachs Global Investment Research, Data from 12/31/1965-2/28/2022. Past performance does not guarantee future results.

Source Bloomberg LP, US Consumer Price Index % Change YoY, Generic US 10 Year Treasury Yield. Past performance does not guarantee future results.

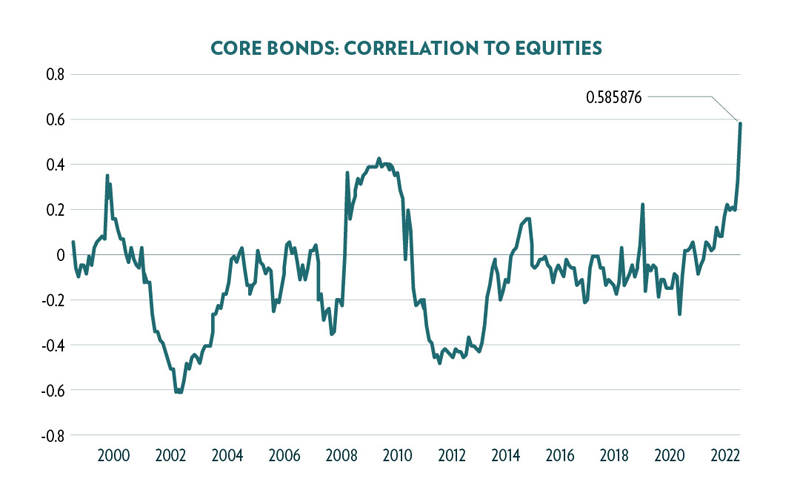

Diversification Frustration

Investors relying on bonds to mitigate their equity risk have likely been disappointed this year. The Bloomberg US Aggregate Bond Index sold off 6% in Q1, in-line with sell-off in the S&P 500. The bond’s diversification benefits may not to be returning anytime soon. Bond-equity correlation remains at a multi-decade high as the two continue to share the same risks (i.e. Fed, Inflation, rates).

Finally, even if rates do begin to level off, current yields are still binding for total returns. Generating a positive real return from current yield levels will be difficult. All in all, I believe bondholders are facing above average risk with potentially diminished benefits in a portfolio.

Source: Bloomberg LP. Data from 7/30/1999-2/28/2022. Past performance does not guarantee future results.

A New Cycle Calls for New Solutions

As discussed in last month’s blog, I continue to believe finding ways to maintain and even increase equity exposure, while keeping a good handle on portfolio risk is appropriate in today’s market. The risk reward tradeoff for bonds is simply not there right now.

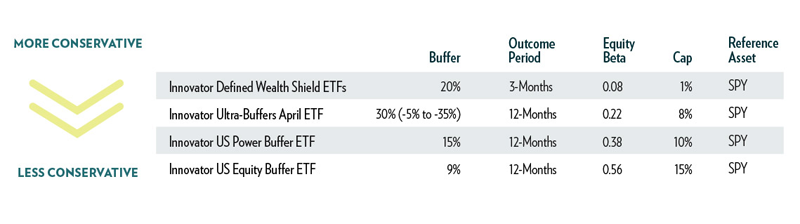

Buffer ETFs are not bonds. They seek to provide upside equity exposure up to a pre-determined cap with a downside buffer over the outcome period. While they are not bonds, I believe what they offer is particularly compelling in today’s market as they can help investors add equity exposure, hedge a policy induced recession, and dial down risk as desired. With a new cycle underway, it’s time to look at new solutions to manage risk.

Consumer Price Index (CPI): a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

Fed Funds Rate: the target interest rate set by the FOMC. This is the rate at which commercial banks borrow and lend their excess reserves to each other overnight.

Correlation: in the finance and investment industries, is a statistic that measure the degree to which two securities move in relation to each other. A positive correlation indicates the securities move in line with each other while a negative correlation indicates the opposite.

Beta: describes the sensitivity of a security to a reference asset.

An Important Note about Buffers ETFs and Bonds

Buffer ETFs seek to track the return of an equity-based reference asset, to a cap, while targeting a 9%, 15%, 20% or 30% buffer against losses over the outcome period. Buffer ETFs carry equity risk, which has historically been greater than bond risk. In order to produce a positive return, Buffer ETFs need equities to rise. If the equities fall more than the predetermined buffer, investors risk a loss.

Unlike bonds, Buffer ETFs will not rise when equities fall. Unlike equities, bonds pay coupons and their returns are not directly tied to the equity market. The price of a bond does not need to increase for an investor to profit. In addition, the price of a bond can also be affected by supply and demand. As a result bonds price have historically risen when equities have fallen as investors seek safety outside of equities.. Bonds have maturity dates at which point principal must be repaid or a default occurs. Bonds are higher in the capital structure than equities and therefore carry significantly lower risk of loss.

In addition, Buffer ETFs do not seek to provide income which is the typical investment objective of bond funds. Options provide exposure to the price return of the respective reference asset and therefore investors do not receive dividends or investment income through an investment in a Buffer ETF.

The funds only seek to provide their investment objective, which is not guaranteed, over the course of an entire outcome period. Investors who purchase shares after or sell shares before the end of an outcome period will experience very different outcomes than the funds seek to provide.

The Funds have characteristics unlike many other traditional investment products and may not be suitable for all investors. For more information regarding whether an investment in the Fund is right for you, please see Investor Suitability" in the prospectus.

The Funds are designed to provide point-to-point exposure to the price return of a reference asset via a basket of Flex Options. As a result, the ETFs are not expected to move directly in line with the reference asset during the interim period. Additionally, FLEX Options may be less liquid than standard options. In a less liquid market for the FLEX Options, the Fund may have difficulty closing out certain FLEX Options positions at desired times and prices.

Fund shareholders are subject to an upside return cap (the Cap) that represents the maximum percentage return an investor can achieve from an investment in the funds' for the Outcome Period, before fees and expenses. If the Outcome Period has begun and the Fund has increased in value to a level near to the Cap, an investor purchasing at that price has little or no ability to achieve gains but remains vulnerable to downside risks. Additionally, the Cap may rise or fall from one Outcome Period to the next. The Cap, and the Fund's position relative to it, should be considered before investing in the Fund. The Funds' website, www.innovatoretfs.com, provides important Fund information as well information relating to the potential outcomes of an investment in a Fund on a daily basis.

The Funds only seek to provide shareholders that hold shares for the entire Outcome Period with their respective buffer level against reference asset losses during the Outcome Period. You will bear all reference asset losses exceeding the buffer. Depending upon market conditions at the time of purchase, a shareholder that purchases shares after the Outcome Period has begun may also lose their entire investment. For instance, if the Outcome Period has begun and the Fund has decreased in value beyond the pre-determined buffer, an investor purchasing shares at that price may not benefit from the buffer. Similarly, if the Outcome Period has begun and the Fund has increased in value, an investor purchasing shares at that price may not benefit from the buffer until the Fund's value has decreased to its value at the commencement of the Outcome Period.

The Funds' investment objectives, risks, charges and expenses should be considered carefully before investing. The prospectus contains this and other important information, and it may be obtained at innovatoretfs.com. Read it carefully before investing.

Innovator ETFs are distributed by Foreside Fund Services, LLC.