March 1, 2022

The Market Loves Clarity…. Will it Come Anytime Soon?

Tim Urbanowicz, CFA

Head of Research & Investment Strategy

Innovator Capital Management

As a dad of four, ages five and under, I’ve spent my fair share of time scanning books and articles on parenting, searching for tips or tricks that might work with my kids. While not every tip works, the best one I’ve picked up so far has been related to discipline. Specifically, the art of delaying communication of what the actual discipline will be. My natural inclination when observing a negative behavior is to immediately assign a punishment, however, the advice is to calmly tell the child you need to think about the discipline and let them know later. So far, it’s worked great. They crave clarity so badly, the anticipation itself serves as a discipline. It gives them time to think about what they did and what they might want to do differently in the future. Once the waiting game is over and they have clarity, the actual punishment is a relief.

Just like a toddler, the markets crave clarity and are being punished because they don’t have it. How aggressive will the Fed be in the fight against inflation? How severe will US and EU sanctions of Russia be and what impact will that have on energy prices? All very important, but unlikely to be known anytime soon. The March 16th meeting, when the Fed will likely announce the magnitude of the first hike, may provide some clarity and some relief, but until the Fed truly gets control of inflation, there will be uncertainty. Does this mean we should sell or trim equity exposure in a portfolio until the dust settles? Not at all, in fact I feel quite the opposite. I believe finding ways to maintain and even increase equity exposure while keeping a good handle on portfolio risk is the best approach. Here are three reasons why:

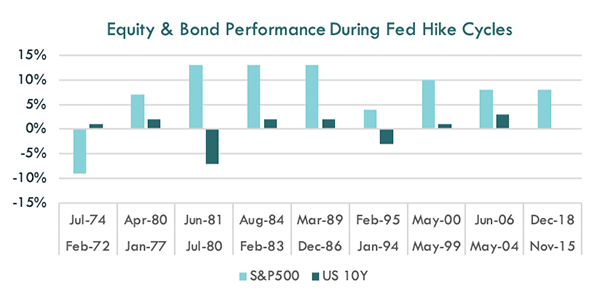

#1 -- Equities Have Digested Fed Hikes Well, Bonds have Not

Looking at every Fed hike cycle since 1972, equities produced an average annualized return of 8% with positive returns 89% of the time. Bonds* on the other hand provided an average return of 0% with returns ranging from -7% to +3%.

Source: Goldman Sachs Global Investment Research, data from Feb 1972-Dec 2021

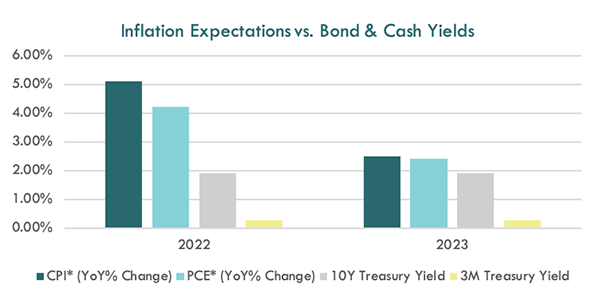

#2 -- Continued Inflation will Erode Bond and Cash Returns

Sitting on the sidelines and waiting for the dust to settle may sound like a viable option, but bond and cash returns are unlikely to keep pace with inflation. The median forecast for the CPI (consumer price index) in 2022 is 5.1% and in 2023 2.5%. With the 10year yield under 2% and cash yields still hovering near zero, producing a positive real return from either will be unlikely if inflation clocks in anywhere near current estimates.

Source: Bloomberg LP as of 2/24/2022, Median Economist Forecast, *CPI- Consumer Price Index, PCE- Personal Consumption Expenditure Index

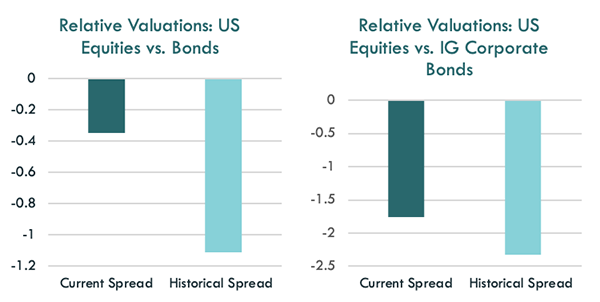

#3 -- There is no Better Alternative

Equity valuations have derated meaningfully this year, providing a more attractive entry point than the start of the year. The forward price-to-earnings on the S&P 500 has come down from 22X to start the year to under 19X today. Additionally, equities continue to score well relative to both bonds and credit. The dividend yield vs. bond yield, earnings yield vs. bond yield, and dividend yield vs. investment grade credit* yield gap, is 0.76%, 0.4%, and 0.56% better respectively than historical norm, highlighting the relative attractiveness of equities.

Source: Bloomberg LP as of 2/24/2022, Average data from 1/31/2001-1/31/2022

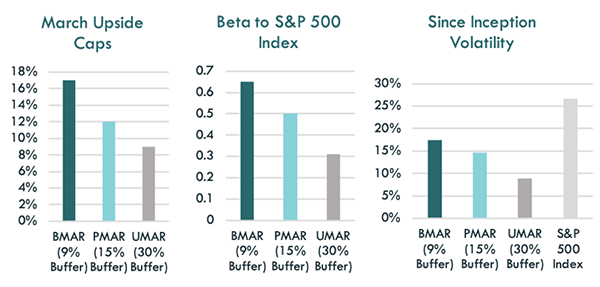

Adding Equity Exposure without Taking on Equity Like Risk

Waiting for clarity can be difficult and keeping clients invested amidst equity volatility is even more challenging. Innovator Defined Outcome ETFs™ may be a great tool to help add equity exposure, without taking on the full risk of the equity market. The ETFs seek upside participation of a reference asset to a cap, with a pre-determined buffer against losses over the outcome period. The charts below highlight the caps and buffer levels of Innovator’s March U.S. Equity Buffer series, as well as historical beta and volatility of each strategy. Given these metrics, we believe these strategies are a viable option to help increase equity exposure while keeping a good handle on portfolio risk while we wait for clarity.

Source: Innovator Capital Management

*10 Year US Treasury Returns

Investment Grade Credit: Debt issued from a corporation that has an investment grade rating by one of the three major rating agencies

Beta: A measure of sensitivity relative to another asset.

Volatility: The standard deviation or dispersion of returns for a given security.

An Important Note about Buffers and Bonds

Buffer ETFs seek to track the return of an equity-based reference asset, to a cap, while targeting a 9%, 15%, 20% or 30% buffer against losses over the outcome period. Buffer ETFs carry equity risk, which has historically been greater than bond risk. In order to produce a positive return, Buffer ETFs need equities to rise. If the equities fall more than the predetermined buffer, investors risk a loss.

Unlike bonds, Buffer ETFs will not rise when equities fall. Unlike equities, bonds pay coupons and their returns are not directly tied to the equity market. The price of a bond does not need to increase for an investor to profit. In addition, the price of a bond can also be affected by supply and demand. As a result bonds price have historically risen when equities have fallen as investors seek safety outside of equities.. Bonds have maturity dates at which point principal must be repaid or a default occurs. Bonds are higher in the capital structure than equities and therefore carry significantly lower risk of loss.

In addition, Buffer ETFs do not seek to provide income which is the typical investment objective of bond funds. Options provide exposure to the price return of the respective reference asset and therefore investors do not receive dividends or investment income through an investment in a Buffer ETF.

The funds only seek to provide their investment objective, which is not guaranteed, over the course of an entire outcome period. Investors who purchase shares after or sell shares before the end of an outcome period will experience very different outcomes than the funds seek to provide.

The Funds have characteristics unlike many other traditional investment products and may not be suitable for all investors. For more information regarding whether an investment in the Fund is right for you, please see Investor Suitability" in the prospectus.

The Funds are designed to provide point-to-point exposure to the price return of a reference asset via a basket of Flex Options. As a result, the ETFs are not expected to move directly in line with the reference asset during the interim period. Additionally, FLEX Options may be less liquid than standard options. In a less liquid market for the FLEX Options, the Fund may have difficulty closing out certain FLEX Options positions at desired times and prices.

Fund shareholders are subject to an upside return cap (the Cap) that represents the maximum percentage return an investor can achieve from an investment in the funds' for the Outcome Period, before fees and expenses. If the Outcome Period has begun and the Fund has increased in value to a level near to the Cap, an investor purchasing at that price has little or no ability to achieve gains but remains vulnerable to downside risks. Additionally, the Cap may rise or fall from one Outcome Period to the next. The Cap, and the Fund's position relative to it, should be considered before investing in the Fund. The Funds' website, www.innovatoretfs.com, provides important Fund information as well information relating to the potential outcomes of an investment in a Fund on a daily basis.

The Funds only seek to provide shareholders that hold shares for the entire Outcome Period with their respective buffer level against reference asset losses during the Outcome Period. You will bear all reference asset losses exceeding the buffer. Depending upon market conditions at the time of purchase, a shareholder that purchases shares after the Outcome Period has begun may also lose their entire investment. For instance, if the Outcome Period has begun and the Fund has decreased in value beyond the pre-determined buffer, an investor purchasing shares at that price may not benefit from the buffer. Similarly, if the Outcome Period has begun and the Fund has increased in value, an investor purchasing shares at that price may not benefit from the buffer until the Fund's value has decreased to its value at the commencement of the Outcome Period.

The Funds' investment objectives, risks, charges and expenses should be considered carefully before investing. The prospectus contains this and other important information, and it may be obtained at innovatoretfs.com. Read it carefully before investing.

Innovator ETFs are distributed by Foreside Fund Services, LLC.