May 12, 2022

A Buffer in the Hand

Tim Urbanowicz, CFA

Head of Research & Investment Strategy

Innovator Capital Management

Recession fears are rising and after a few soft economic readings, the conversation for many advisors is quickly shifting from “if” to “when”. Defensive equity strategies are raking in the cash on these fears, with low volatility ETFs netting $1.1 billion in April alone. But relying on historical volatility, correlations, or defensive sectors, as many low volatility strategies do, comes with its own unique set of challenges in today’s market. Below we explore these challenges and discuss why I believe Buffer ETFs may provide what investors are looking for without the guesswork that comes along with low volatility investing.

Low Volatility Sectors are Now Expensive

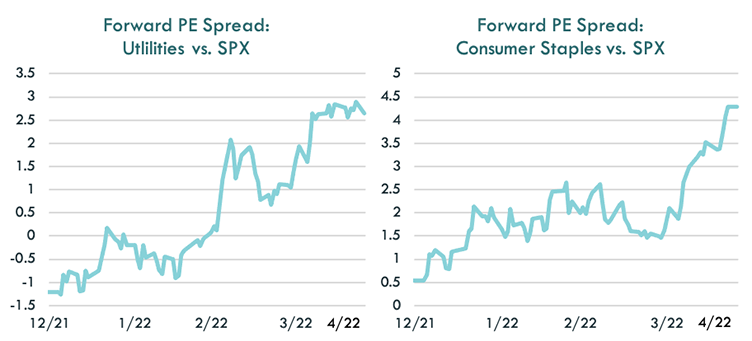

Low volatility strategies can rely heavily on defensive sectors for protection, which have been bid up quite a bit. On a forward price to earnings basis, utilities and consumer staples are now trading at a 15% and 23% premium to the S&P 500 respectively, up from a 5% discount and 1% premium to start the year. The S&P 500 Low Volatility Index, one of the most widely adopted indices, currently has a 22% overweight to utilities and a 16% overweight to consumer staples, funded by a 20%+ underweight to technology. While smaller, the MSCI USA Minimum Volatility Index also has a meaningful overweight to both utilities and staples (plus roughly 5% each). Even if these sectors were to maintain their premium relative to the broad equity market, is this a bet investor want to make amidst all the other uncertainty?

Source: Bloomberg LP as of 4/30/2022, S&P 500 Utilities Sector Index, S&P 500 Consumer Staples Index

Everything Works Until It Doesn’t

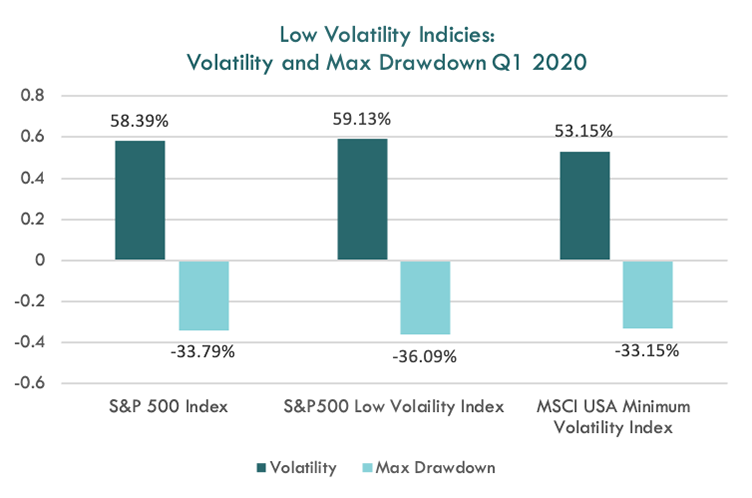

Everything works until it doesn’t and I believe low volatility strategies are no exception. The initial Covid-19 market shock in 2020 serves as a great reminder that lower historical volatility does not always translate into lower future volatility and historical relationships can break down. Throughout 1Q2020, the MSCI USA Minimum Volatility Index and the S&P 500 Low Volatility Index, saw little to no reduction in volatility relative to the broad US equity market with a similar maximum drawdown.

Source: Bloomberg LP as of 3/31/2020

Buffer ETFs Seek to Remove the Guesswork

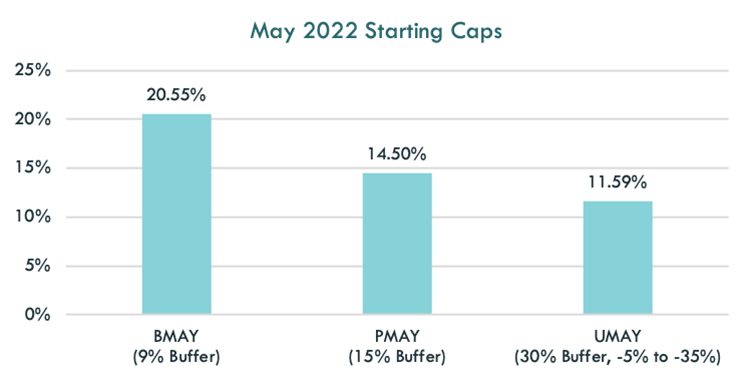

I believe Buffer ETFs continue to be a compelling alternative to traditional low volatility strategies, providing investors with a more consistent risk profile relative to the broad equity market. With Buffer ETFs, the upside participation level, via a cap, and the downside buffer level predefined. There is no relying on historical volatility or correlations to deliver the experience, just a known buffer against loss over the outcome period. The knock, however, is that if the market rips back, a Buffer ETF will be capped out and potentially miss out on the move. While this certainly is valid, it is important to remember that caps have historically been correlated with both volatility and interest rates. Because of this dynamic, the April caps were elevated. BMAY, the Innovator 9% Buffer ETF just rebalanced to a 20.55% starting cap, the highest yet in the fund’s history.

And finally, if being capped out is a concern, is a ~40% overweight to consumer staples and utilities a better alternative? I’ll take a Buffer in the hand.

The S&P 500 Low Volatility Index measures performance of the 100 least volatile stocks in the S&P 500.

The MSCI Minimum Volatility Index is designed to serve as transparent benchmarks for minimum variance or managed volatility equity strategies.

The S&P 500 Utilities Index comprises those companies included in the S&P 500 that are classified as members of the GICS® utilities sector.

The S&P 500 Consumer Staples comprises those companies included in the S&P 500 that are classified as members of the GICS® consumer staples sector.

Max drawdown is the maximum observed loss from a peak to a trough of a portfolio, before a new peak is attained.

The funds only seek to provide their investment objective, which is not guaranteed, over the course of an entire outcome period. Investors who purchase shares after or sell shares before the end of an outcome period will experience very different outcomes than the funds seek to provide.

The Funds have characteristics unlike many other traditional investment products and may not be suitable for all investors. For more information regarding whether an investment in the Fund is right for you, please see Investor Suitability" in the prospectus.

The Funds are designed to provide point-to-point exposure to the price return of a reference asset via a basket of Flex Options. As a result, the ETFs are not expected to move directly in line with the reference asset during the interim period. Additionally, FLEX Options may be less liquid than standard options. In a less liquid market for the FLEX Options, the Fund may have difficulty closing out certain FLEX Options positions at desired times and prices.

Fund shareholders are subject to an upside return cap (the Cap) that represents the maximum percentage return an investor can achieve from an investment in the funds' for the Outcome Period, before fees and expenses. If the Outcome Period has begun and the Fund has increased in value to a level near to the Cap, an investor purchasing at that price has little or no ability to achieve gains but remains vulnerable to downside risks. Additionally, the Cap may rise or fall from one Outcome Period to the next. The Cap, and the Fund's position relative to it, should be considered before investing in the Fund. The Funds' website, www.innovatoretfs.com, provides important Fund information as well information relating to the potential outcomes of an investment in a Fund on a daily basis.

The Funds only seek to provide shareholders that hold shares for the entire Outcome Period with their respective buffer level against reference asset losses during the Outcome Period. You will bear all reference asset losses exceeding the buffer. Depending upon market conditions at the time of purchase, a shareholder that purchases shares after the Outcome Period has begun may also lose their entire investment. For instance, if the Outcome Period has begun and the Fund has decreased in value beyond the pre-determined buffer, an investor purchasing shares at that price may not benefit from the buffer. Similarly, if the Outcome Period has begun and the Fund has increased in value, an investor purchasing shares at that price may not benefit from the buffer until the Fund's value has decreased to its value at the commencement of the Outcome Period.

The Funds' investment objectives, risks, charges and expenses should be considered carefully before investing. The prospectus contains this and other important information, and it may be obtained at innovatoretfs.com. Read it carefully before investing.

Innovator ETFs are distributed by Foreside Fund Services, LLC.