October 19, 2022

Are Rates Done Moving Higher?

Tim Urbanowicz, CFA

Head of Research & Investment Strategy

Innovator Capital Management

Interest rates have skyrocketed across the curve this year. The 10 Year Treasury yield has jumped 250%+, rising from 1.51% at the start of the year, to 3.95% today. Investors holding long dated bonds have received a crash course on duration. The ICE US Treasury 20+ Year Bond Index, for example, is down over 30% YTD, significantly more than equities.

Rates are difficult to forecast. Don’t believe me? Take a look back at the various 10-year yield targets generated over the past 3 years compared to what actually happened; the targets show a wide dispersion to say the least. But right now, even after the spike this year, we have good reason to believe that rates could continue to face pressures into 2023. In addition to the continued threat of stubborn inflation and subsequent Fed hikes, we also see a demand issue developing. How high will rates go? No one knows, but ultimately, we believe it will be determined by demand.

Artificially Low

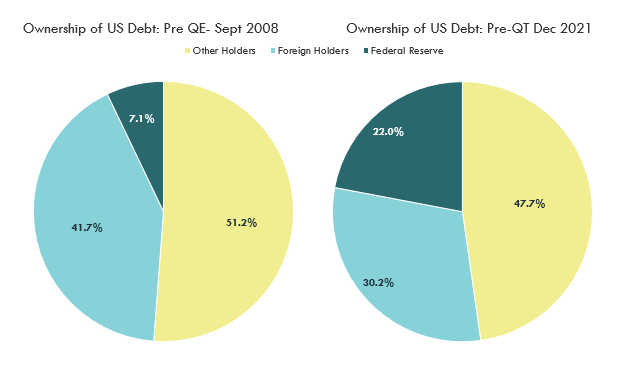

The Fed is a huge deal. The two pie charts below show how much of the treasury market the Fed owned pre-quantitative easing, and how much they own today. It’s a massive difference. They went from owning 7% of the $6 trillion treasury market in 2008 to 22% of the $25 trillion treasury market today. By buying up 22% of the market, the Fed was able to artificially suppress interest rates and volatility in the treasury market. But that is no longer the case.

Source: Bloomberg LP as of 10/1/2022

Artificially Low No More

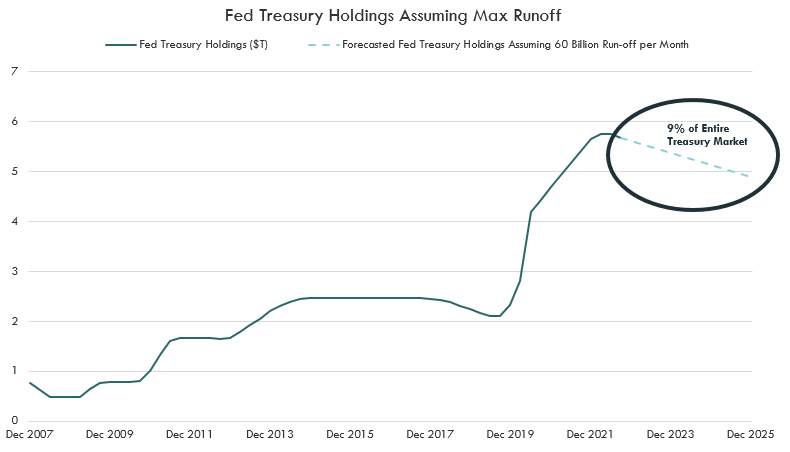

Back in May, the Fed announced plans to reduce the size of its balance sheet, initially allowing a runoff of up to $30 billion of treasuries per month and increasing that to a cap of $60 billion after three months. While there is discretion and $60 billion is the cap, it’s a big one. To put $60 billion per month into context, hypothetically, if the Fed were to move at that stated clip, by the end of 2025, the total runoff would represent ~9% of the entire treasury market. That is a lot of money that needs to find a home.

Source: Bloomberg LP, Innovator Research, as of 10/1/2022

Other Sources of Demand are Fading

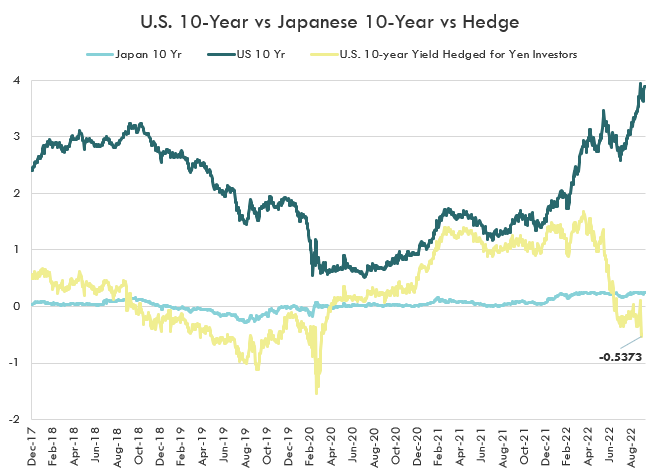

In addition to the Fed, other major buyers are also stepping back. Foreign holders, the second largest consumer historically, have sold a net $50 billion in the last 6 months. Looking at Japan, the biggest of the foreign holders, net of currency hedging costs, the yield on a US treasury is negative and well below the yield on the Japanese 10-year. Additionally, in an effort to support the tumbling Yen, the Bank of Japan, will likely sell down their treasury stockpile, adding further pressure to US treasury yields.

Source: Bloomberg LP as of 10/10/2022

What Rate will Investors Require?

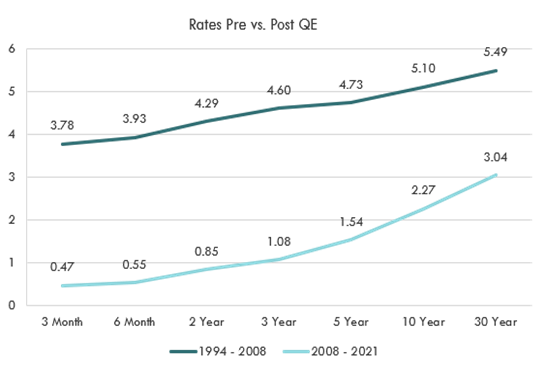

Without the artificial bid from the Fed, interest rates now need to compete for investor dollars like they did before. Pre quantitative easing, after the financial crisis, interest rates were higher. The line chart below shows the average yield by maturity in the 14 years leading up to Quantitative easing (QE) vs. the average yield by maturity in the 14 years following QE. What rate will investors require to pick up the slack this time? No one knows, but pre-QE, the figure was higher than it is right now and now there is a lot more debt needing to find a home.

Source: Bloomberg LP

Portfolio Implications

Investing is all about managing risk and return, and focusing on risks we are compensated for. With a Fed seemlingly dead set on stopping inflation and these supply/demand issues, even with yields at their highest level since the financial crisis, we still see adding unhedged duration into a portfolio as a poor bet. While equities continue to be sensitive to rate changes, we see the risk/reward tradeoff as more favorable, given the severity of the sell-off this year. As such, we continue to favor cautiously increasing equity exposure in a portfolio and believe investors may be better off tying their “lower risk” dollars to the equity market as opposed to the bond market.

Quantitative easing (QE) is a monetary policy where central banks spur economic activity by buying a range of financial assets in the market.

The ICE US Treasury 20+ Year Bond Index is is designed to measure the performance of U.S. dollar-denominated, fixed rate securities with minimum term to maturity greater than twenty years.