October 3, 2022

What to Watch - Slow to Start, Slow to Stop?

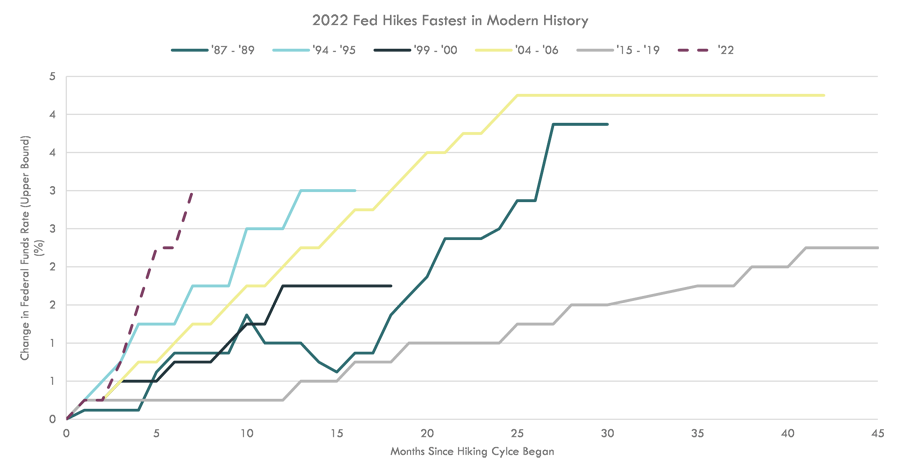

The Fed got off to a severely delayed start in the fight against inflation. The headline Consumer Price Index (CPI) touched 7.9% on a year-over-year basis before they finally packed up their tent in the transitory camp and began hiking interest rates. After this delay, the Fed has since hiked rates at the highest clip ever seen over the past 30 years.

Source: Bloomberg LP

Just as we feared the Fed’s slow start to interest rate hikes; we now fear they will be slow to stop. In our view, the damage to the economy will ultimately be determined by how high the Fed takes rates, and how long they remain there. Historically, metrics such as growth, inflation, and unemployment often respond with a lag to Fed rate hikes. Given how aggressive the Fed continues to be, we see the risk of overtightening increasing rapidly. In this month’s commentary, we provide context on this dynamic and examine how long interest rate hikes have historically taken to meaningfully impact the economic data.

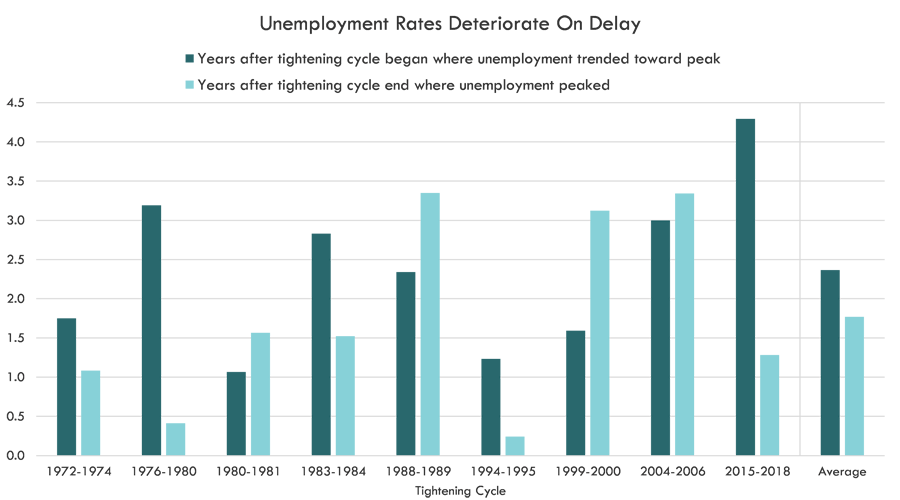

On Average Unemployment Rises ~29 Months Post First Hike

The unemployment rate is a good demonstration of the lagged nature of monetary policy. As expected, all of the tightening cycles from 1972 to present resulted in higher unemployment at the end, compared the beginning of the rate hike campaign. On average, unemployment has begun to rise around 29 months after the first Fed hike, and has peaked 22 months after the last hike. Non-farm payrolls have been quicker to react, but still take 3 years on average to bottom.

Source: Bloomberg LP, US Bureau of Economic Analysis

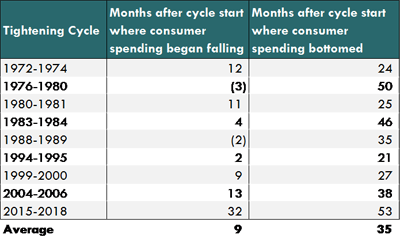

Consumer Spending Takes Time to Drop

Interest rate hikes make borrowing money more costly for everyone. Consumers see this in the form of higher mortgages, auto loans, credit card rates, and more. Potential homebuyers have typically been quick to react to higher rates, as a small change can make a big difference in affordability. Existing home sales often dip one month after rate hikes begin.

Consumer spending, however, has experienced more of a lag. As shown in the table below, consumer spending has peaked anywhere from 3 months before the hike cycle began to 32 months after, and bottomed anywhere from 21 months to 53 months after.

Source: Bloomberg LP. Consumer Spending is measured on year-over-year % basis

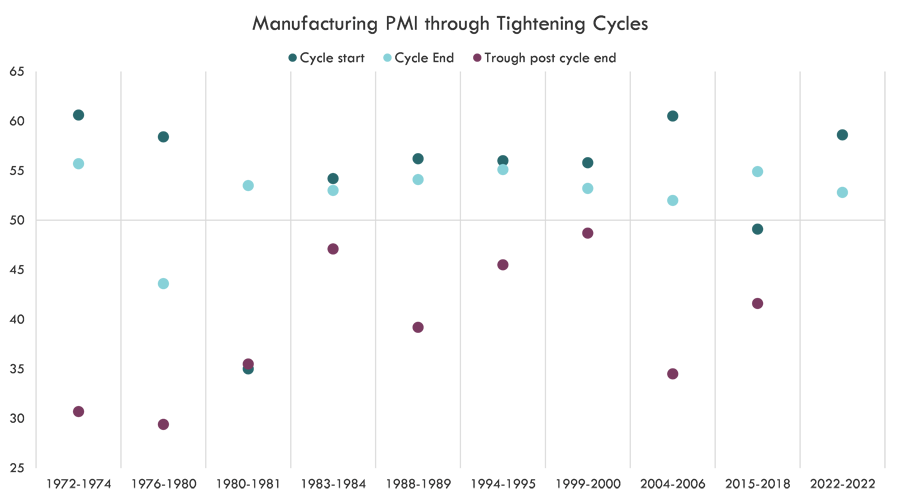

Impact on Business Spending: All Cycles Have Taken the Purchasing Managers Index (PMI) into Contractionary Territory

Going back to 1972, results are mixed on the change in PMIs. Every single tightening cycle has led to PMIs eventually falling below 50 or further into contractionary territory in the cases where the PMI reading was already under 50.

Source: Bloomberg LP

The Bottom Line

As we have seen historically, interest rate hikes take time to meaningfully impact the economy. Given how the Fed’s current pace and magnitude of rate hikes, we see the risk of overtightening growing.

Past performance is not indicative of future results.

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

Federal Funds rate refers to the interest rate that banks charge other institutions for lending excess cash to them from their reserve balances on an overnight basis.

PMI is an index that measures the month-over-month change in economic activity with the manufacturing sector.