May 25, 2022

The Froth is Coming Off

Tim Urbanowicz, CFA

Head of Research & Investment Strategy

Innovator Capital Management

2022 has been a brutal year for risk assets. The Fed’s move towards more restrictive policy has sent speculative parts of the market into an all-out tailspin. Profitless technology stocks are off ~70% from their 2021 highs, SPACs are off 50%, Bitcoin is off 68%, and the retail darling, ARK Innovation ETF is off an additional 40% from Cathie Wood’s “bargain basement” call in February. No doubt a shift in sentiment from the “stocks only go up” mentality of 2020 and 2021.

A Big Move, But What’s Priced In?

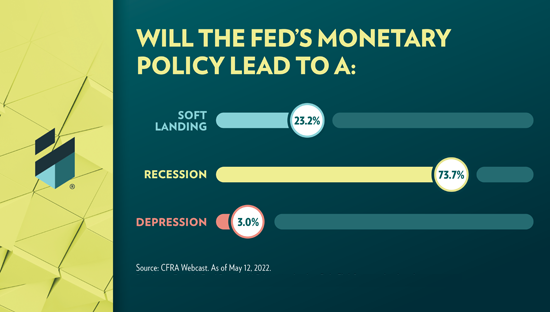

We recently surveyed over 200 financial advisors to see if they believe the Fed can pull off a soft landing and steer the economy away from a recession. 77% of respondents didn’t think so. Interestingly, while this sentiment has clearly been expressed in speculative pockets of the market (i.e., profitless tech), it hasn’t yet trickled through to the broad equity market. Even though the S&P 500 is off 17% from its high, the repricing and new valuation still leaves the S&P 500 nowhere near past recessionary levels.

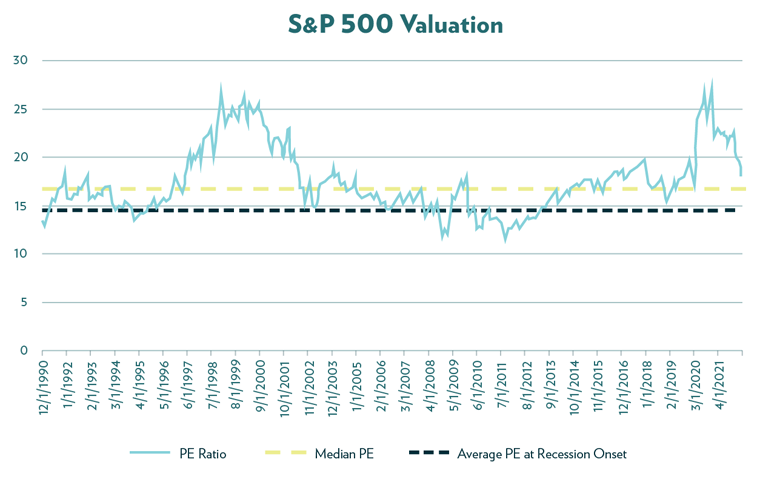

The table below outlines the previous ten U.S. recessions, and the valuation (price to earnings) of the S&P 500 at the onset of the recession. On average, the current valuation of the S&P 500 is 22% above past recessionary levels. Outside of the COVID induced recession and the one in 2001, the S&P is still trading meaningfully above where any recession prior has begun.

Source: Bloomberg LP

Source: Bloomberg LP, data from 12/1/1990 – 4/1/2022

Could this be a Buying Opportunity?

Admittingly, while valuations may be elevated right now, the 2022 repricing may be the “better entry point” so many have been waiting for if the Fed can thwart a recession. After all, we have not seen valuations this low since Q1 2020.

This is no doubt a gamble (with poor odds in my opinion) and dip buyers have been punished thus far this year. If the Fed does pull it off, it would be the first time they were able to avoid a recession with inflation this high. And let’s not forget the balance sheet runoff that will be pursued in tandem.

Hedge a Recession & Recovery All in One

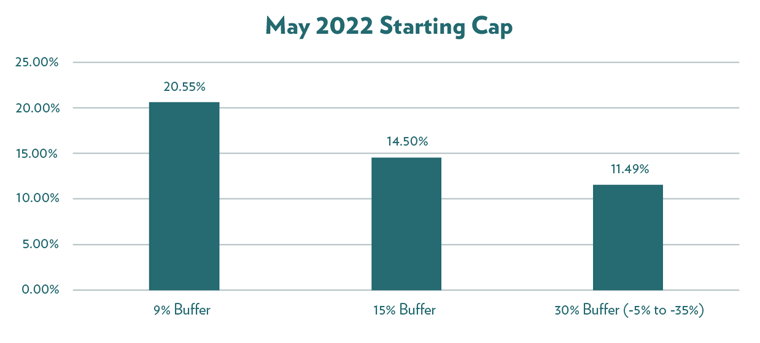

With all the risk and increased volatility, I believe this is one of the reasons Buffer ETF assets have grown. This year alone, Innovator’s Buffer ETFs have seen ~$1.7B of new net inflows, a 25% boost in shares outstanding in just 4.5 months. Also notable, 20% of the flows have gone into the 30% Buffers, highlighting investors’ desire for increased buffers against loss. I believe another reason for the uptick is the funds’ caps; with the current market conditions and high volatility, we are seeing some of the highest caps in history.

The Innovator U.S. Equity Ultra Buffer ETF – May (UMAY) seeks a 30% buffer against losses over a 12-month outcome period, and reset with a 11.59% cap. With buffers of 9%, 15%, and 30% over 12-months, and a 20% Buffer each quarter to choose from, I believe these ETFs may provide an attractive option to hedge recession risk while simultaneously providing a call option on a soft landing.

The price to earnings ratio (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its earnings per share.

Risk Assets refer to any asset, such as a stock or bond, that carries investment risk

The funds only seek to provide their investment objective, which is not guaranteed, over the course of an entire outcome period. Investors who purchase shares after or sell shares before the end of an outcome period will experience very different outcomes than the funds seek to provide.

The Funds have characteristics unlike many other traditional investment products and may not be suitable for all investors. For more information regarding whether an investment in the Fund is right for you, please see Investor Suitability" in the prospectus.

The Funds are designed to provide point-to-point exposure to the price return of a reference asset via a basket of Flex Options. As a result, the ETFs are not expected to move directly in line with the reference asset during the interim period. Additionally, FLEX Options may be less liquid than standard options. In a less liquid market for the FLEX Options, the Fund may have difficulty closing out certain FLEX Options positions at desired times and prices.

Fund shareholders are subject to an upside return cap (the Cap) that represents the maximum percentage return an investor can achieve from an investment in the funds' for the Outcome Period, before fees and expenses. If the Outcome Period has begun and the Fund has increased in value to a level near to the Cap, an investor purchasing at that price has little or no ability to achieve gains but remains vulnerable to downside risks. Additionally, the Cap may rise or fall from one Outcome Period to the next. The Cap, and the Fund's position relative to it, should be considered before investing in the Fund. The Funds' website, www.innovatoretfs.com, provides important Fund information as well information relating to the potential outcomes of an investment in a Fund on a daily basis.

The Funds only seek to provide shareholders that hold shares for the entire Outcome Period with their respective buffer level against reference asset losses during the Outcome Period. You will bear all reference asset losses exceeding the buffer. Depending upon market conditions at the time of purchase, a shareholder that purchases shares after the Outcome Period has begun may also lose their entire investment. For instance, if the Outcome Period has begun and the Fund has decreased in value beyond the pre-determined buffer, an investor purchasing shares at that price may not benefit from the buffer. Similarly, if the Outcome Period has begun and the Fund has increased in value, an investor purchasing shares at that price may not benefit from the buffer until the Fund's value has decreased to its value at the commencement of the Outcome Period.

The Funds' investment objectives, risks, charges and expenses should be considered carefully before investing. The prospectus contains this and other important information, and it may be obtained at innovatoretfs.com. Read it carefully before investing.

Innovator ETFs are distributed by Foreside Fund Services, LLC.