July 29, 2022

Welcome to the Recession

Tim Urbanowicz, CFA

Head of Research & Investment Strategy

Innovator Capital Management

Last week’s Q2 Gross Domestic Product (GDP) print showed the economy shrank at a 0.9% pace…well below the consensus estimated 0.4% and checking off the “technical definition” of a recession. Whether or not the National Bureau of Economic Research (NBER) will officially classify this as a recession remains to be seen, however, there has never been an instance of two consecutive negative quarters of GDP growth without it. We shall see. Regardless, and much more importantly, it is very clear the economy is slowing rapidly. The labor market, which the Fed and the Biden Administration continue to praise, is starting to crack. While jobless claims remain below prior recessionary levels, they continue to push higher and many of the largest corporations have recently announced they will slow hiring.

Financial markets, however, seem unphased with the equity market up 7% in Q3. What is driving this shift? It seems we are back to the bad news is good news mentality, with many believing the slowdown will force the Fed to take its foot off the accelerator. We think this could be a costly mistake with a high price tag. Here is why:

The Fed Will Continue to Prioritize Cost of Living Over Growth

Currently, Fed Fund Futures imply the Fed will shift from rate hikes to rate cuts in 2023. While this sentiment reflects the weakening macro backdrop, it ignores the fact that inflation has shown few signs of reprieve. Until it does, the Fed will continue to skew efforts towards fighting inflation in the tradeoff between tightening and slowing growth. Additionally, the Wealth Effect, (consumers spend more when they feel wealthier given a higher investment portfolio), will be an opposing force to the Fed’s main objective.

How Long Will Policy Need to Be Restrictive?

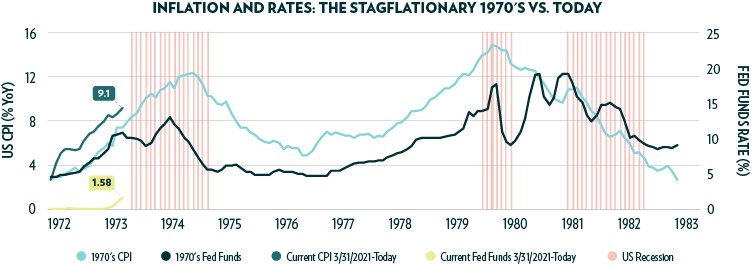

After last week’s 0.75% hike, the Fed policy rate is likely on the cusp of moving into restrictive territory. The length and severity of the recession will likely be driven by how long the Fed remains there, and this is a wild card. Based on history, we understand it could take time. The last time inflation was this high it took three recessions and the “Volker Shock” to fix inflation (read more in last week’s What to Watch- Inflation Now vs. the 1970’s). Thus far, Americans have battled inflation on the backs of a very strong labor market. This is starting to change and if it continues, has the ability to compound the pain Americans already feel from higher prices, and dramatically slow growth.

Source: Bloomberg LP as of 7/13/2022

Earnings & Valuations Appear Disconnected from the Growth Outlook

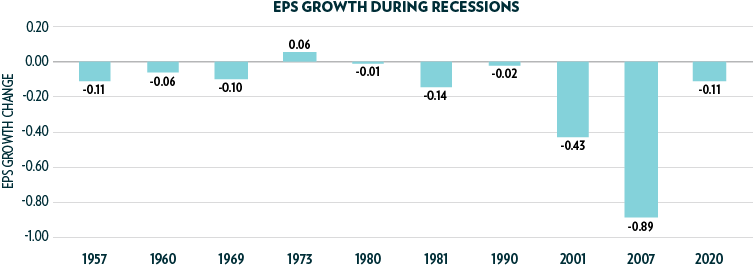

Valuations do not appear to be reflecting a recessionary drop and neither do earnings estimates. The current Price to Earnings multiple on the S&P 500 Index of 19X earnings, is ~25% above the recessionary norm. Consensus earnings estimates are calling for growth of ~10% this year, while margin growth is expected to tick up from the highs. Compare this to the typical recessionary contraction in earnings of -18% and margins of -1.3%, peak to trough.

Source: Gurufocus, 7/2/2022

Source: Goldman Sachs Global Investment Research

Appropriate Risk Management is of Particular Importance Right Now

Understanding these dynamics in light of the current backdrop, we see the risk of heighted drawdowns and continued volatility over the next 12 months. The “Fed Put” is likely bygone, at least until inflation comes back down to a reasonable level. Implementing a Buffered or hedged equity strategy to manage risk may be prudent as the current disconnect leaves the equity market particularly vulnerable.