December 9, 2022

Defined Outcome Investing: The Trends that Defined 2022

Tim Urbanowicz, CFA

Head of Research & Investment Strategy

Innovator Capital Management

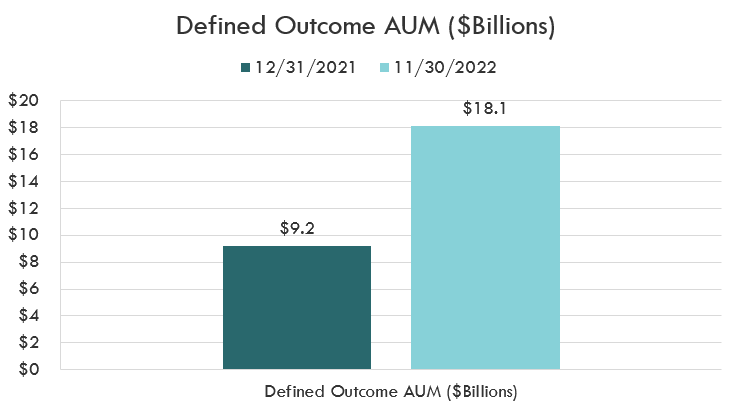

The launch of Innovator’s Defined Outcome ETFs™ in 2018 with the first Buffer ETFs™ opened up a new chapter of investing. Defined Outcome ETFs™ became the first series of ETFs designed to provide financial advisors with scalable, turnkey solutions to include structured payoffs in client portfolios. While availability of the ETFs remains limited at many major broker dealers, use among Registered Investment Advisors (RIAs) has been robust and exploded in 2022, with industry-wide assets growing almost 100% in the first 11 months of the year to $18.1B.

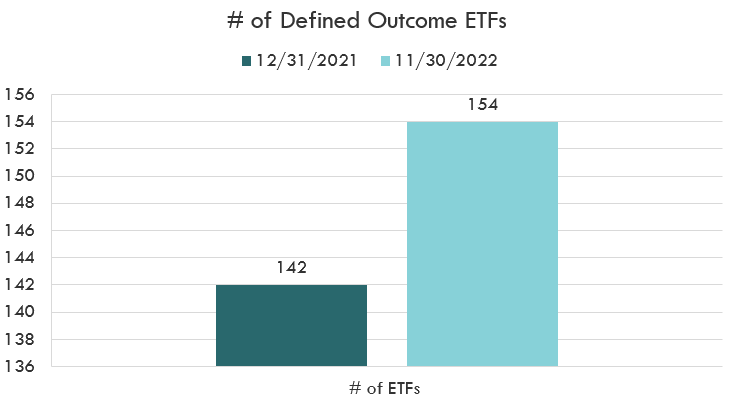

With so many potential applications and various payoff structures across more than 150 ETFs trading today, how are financial advisors using Defined Outcome ETFs™? In this month’s blog, Innovator’s Portfolio Solutions team explores some key use cases and trends in 2022 based on findings from our work with over 350 RIAs and insights these consultations provided.

| Innovator’s Portfolio Solutions team partners with financial advisors to provide custom solutions, creative product applications, and various tools to help manage risk and return characteristics within a portfolio. |

|

|

Source: Bloomberg LP, AUM Snapshot 12/31/2021, 11/30/2022 |

Source: Bloomberg LP, 12/31/2021, 11/30/2022 |

A Dedicated Buffer Sleeve

The ETF structure offers many potential benefits to defined outcome investors; among them, ease of implementation is atop the list. The ETF opens up the ability for advisors to hold these strategies inside a wrap account, also known as a Separately Managed Account (SMA). According to estimates from the Portfolio Solutions team, this advantage was evident in 2022. Nearly 70% of portfolio allocations were made by taking a 10%-30% pro rata allocation from advisors’ current models or client accounts. Of those allocations, roughly 20% of advisors requested that their portfolio be optimized to minimize risk given a desired return target.

| Nearly 70% of potential portfolio allocations to Defined Outcome ETFs were made by taking a 10%-30% pro rata allocation from advisors’ current models or client accounts. Of those allocations, roughly 20% of advisors requested that their portfolio be optimized to minimize risk given a desired return target. |

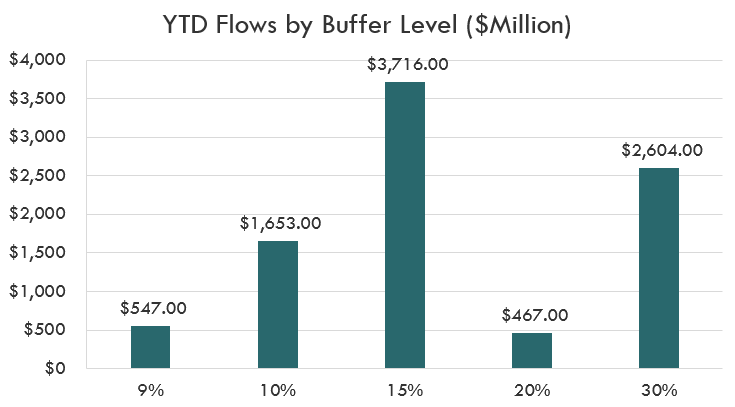

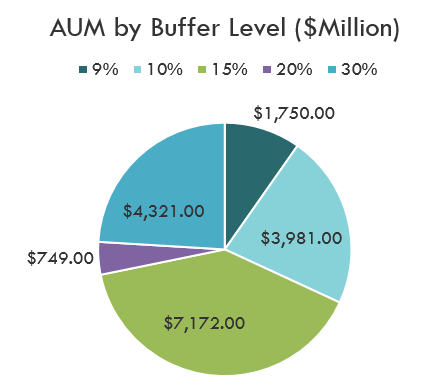

15% Buffer Was the Sweet Spot

$3.7B, or 41% of all 2022 Defined Outcome ETF™ industry net inflows, went into the Innovator 15% Power Buffer ETF™ Series. One potential reason for the outsized flows is that the 15% Buffer consistently saw trades funded from both the equity and the fixed income side of an advisor’s book. Our team estimates that 75% of all Portfolio Solutions requests included an allocation to Innovator’s 15% Buffer Series, with funding split evenly between current equity and fixed income allocations. Other Buffer levels saw more concentrated applications, with 9% Buffer allocations primarily funded from advisors’ equity allocations. The 20% Quarterly Buffer (BALT) and 30% Ultra Buffer allocations, however, were mainly funded from advisors’ bond allocations.

| $3.7B, or 41% of all 2022 Defined Outcome ETF™ industry net inflows, went into the Innovator 15% Power Buffer ETF™ Series |

|

|

Source: Bloomberg LP, 11/30/2022, 30% Buffer includes 25% & 30% Buffer |

Source: Bloomberg LP, 11/30/2022, 30% Buffer includes 25% & 30% Buffer |

Bonds and Cash Equitization/Tertiary Liquidity Bucket

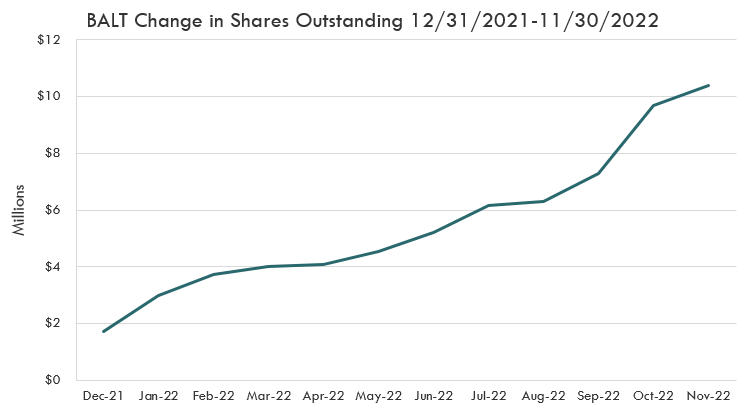

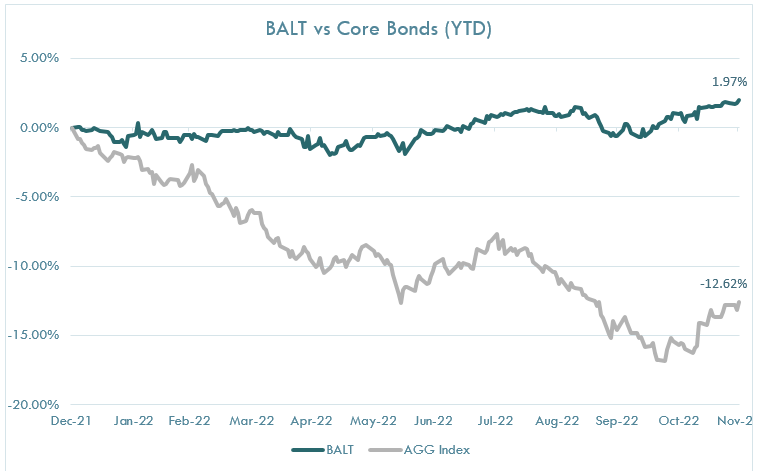

The Innovator Defined Wealth Shield ETF (BALT), which seeks to buffer quarterly losses in the SPDR S&P 500 ETF Trust (SPY) up to 20% while providing a measure of U.S. equity upside, grew rapidly in 2022, with shares outstanding increasing 503% through the end of November. Advisors frequently used BALT to complement or replace core bond positions, given the defensive nature of the 20% quarterly buffer. Other advisors used BALT to help clients get excess cash off the sidelines and into the equity market. Both strategies proved advantageous; with U.S. Large-Cap equities down -13% and the Bloomberg US Aggregate Bond Index losing nearly -12.5%, BALT produced a positive total return of 2% through the end of November.

|

|

Source: Bloomberg LP, 12/31/2021-11/30/2022, BALT Shares Outstanding Index |

Source: Bloomberg LP, 12/31/2021-11/30/2022, Core Bonds represented by the Bloomberg US Aggregate Bond Index |

| Advisor’s frequently used BALT to complement or replace long duration bond positions, given the defensive nature of the 20% quarterly buffer. Other advisors used BALT to help clients get excess cash off the sidelines and into the equity market. |

Buffered-Only Models and Competitive Prospecting

A smaller percentage of firms chose to build out standalone Defined Outcome ETF models (< 5% of Portfolio Solutions cases). The clients that did, however, tended to be larger RIAs with average AUM of over $2B. Many of these large RIAs were looking to compete for structured note business that otherwise would leave the firm, and some were seeking a simpler, more saleable, alternative to their current structured note business. Others were simply looking for a more conservative portfolio that could narrow the range of potential outcomes for clients and prospects and potentially better align with clients’ risk tolerance levels.

Additionally, a large number of advisors also sought to position Defined Outcome ETF™ strategies as a competitive advantage to working with their practice in instances where a prospective account had not yet been won but where the investor was displeased with their current portfolio’s performance. While data was not specifically captured on this side, there were many such anecdotes in 2022 as the dual drawdowns in equities and bonds challenged many traditional portfolios.

| Many of these large RIAs were looking to compete for structured note business that otherwise would leave the firm, and some were seeking a simpler, more saleable, alternative to their current structured note business |

What Trends will Emerge in 2023?

With many of the economic and market-related challenges largely unresolved heading into the new year (e.g., inflation, the path of rates, earnings), we believe many of the Defined Outcome ETF™ trends witnessed in 2022 will continue into 2023. With several new income-focused Defined Outcome ETFs™ anticipated to list in the upcoming months, we expect this maturing group of forward-looking products will be used to not only help investors better manage risk but to potentially enhance yield. Should market risks and volatility begin to dissipate, we anticipate steady growth of Innovator’s Accelerated ETF™ lineup, which seek to provide a multiple of the return of a given market, to a cap, to pick up.

Note data provided is based upon rough estimates of interactions with over 400 wealth management firms and is intended to give readers an idea of how Defined Outcome ETFs™ are potentially being used.

Buffer ETF Risks:

The funds only seek to provide their investment objective, which is not guaranteed, over the course of an entire outcome period. Investors who purchase shares after or sell shares before the end of an outcome period will experience very different outcomes than the funds seek to provide.

The Funds have characteristics unlike many other traditional investment products and may not be suitable for all investors. For more information regarding whether an investment in the Fund is right for you, please see Investor Suitability" in the prospectus.

Investing involves risks. Loss of principal is possible. The Funds face numerous market trading risks, including active markets risk, authorized participation concentration risk, buffered loss risk, cap change risk, capped upside return risk, correlation risk, liquidity risk, management risk, market maker risk, market risk, non-diversification risk, operation risk, options risk, trading issues risk, upside participation risk and valuation risk. For a detail list of fund risks see the prospectus.

FLEX Options Risk The Fund will utilize FLEX Options issued and guaranteed for settlement by the Options Clearing Corporation (OCC). In the unlikely event that the OCC becomes insolvent or is otherwise unable to meet its settlement obligations, the Fund could suffer significant losses. Additionally, FLEX Options may be less liquid than standard options. In a less liquid market for the FLEX Options, the Fund may have difficulty closing out certain FLEX Options positions at desired times and prices. The values of FLEX Options do not increase or decrease at the same rate as the reference asset and may vary due to factors other than the price of reference asset.

Important note about Bonds and Buffer ETFs™

BALT seeks to track the return of the SPDR S&P 500 ETF Trust (SPY), to a cap, while targeting a 20% buffer against losses over the quarterly outcome period. BALT uses FLEX options to gain exposure. Buffer ETFs™ carry equity risk, which has historically been greater than bond risk. In order to produce a positive return, BALT and UJAN need equities to rise. If the equities fall more than the predetermined buffer, investors risk a loss.

Unlike bonds, Defined Outcome ETFs™ will not rise when equities fall. Unlike equities, bonds pay coupons and their returns are not directly tied to the equity market. The price of a bond does not need to increase for an investor to profit. In addition, the price of a bond can also be affected by supply and demand. As a result bonds price have historically risen when equities have fallen as investors seek safety outside of equities. Bonds have maturity dates at which point principal must be repaid or a default occurs. Bonds are higher in the capital structure than equities and therefore carry significantly lower risk of loss. In addition, Buffer ETFs™ do not seek to provide income which is the typical investment objective of bond funds. Options provide exposure to the price-return it’s respective reference asset and therefore investors do not receive dividends or investment income through an investment in a Buffer ETF™.

In seeking to provide a significant measure of downside protection on a quarterly basis, the options-based strategy underpinning BALT will likely offer investors an upside cap that is substantially lower than equity Buffer ETFs™ that operate over an annual outcome period.

The Funds are designed to provide point-to-point exposure to the price return of a reference asset via a basket of Flex Options. As a result, the ETFs are not expected to move directly in line with the reference asset during the interim period. Additionally, FLEX Options may be less liquid than standard options. In a less liquid market for the FLEX Options, the Fund may have difficulty closing out certain FLEX Options positions at desired times and prices.

Fund shareholders are subject to an upside return cap (the Cap) that represents the maximum percentage return an investor can achieve from an investment in the funds' for the Outcome Period, before fees and expenses. If the Outcome Period has begun and the Fund has increased in value to a level near to the Cap, an investor purchasing at that price has little or no ability to achieve gains but remains vulnerable to downside risks. Additionally, the Cap may rise or fall from one Outcome Period to the next. The Cap, and the Fund's position relative to it, should be considered before investing in the Fund. The Funds' website, www.innovatoretfs.com, provides important Fund information as well information relating to the potential outcomes of an investment in a Fund on a daily basis.

The Funds only seek to provide shareholders that hold shares for the entire Outcome Period with their respective buffer level against reference asset losses during the Outcome Period. You will bear all reference asset losses exceeding the buffer. Depending upon market conditions at the time of purchase, a shareholder that purchases shares after the Outcome Period has begun may also lose their entire investment. For instance, if the Outcome Period has begun and the Fund has decreased in value beyond the pre-determined buffer, an investor purchasing shares at that price may not benefit from the buffer. Similarly, if the Outcome Period has begun and the Fund has increased in value, an investor purchasing shares at that price may not benefit from the buffer until the Fund's value has decreased to its value at the commencement of the Outcome Period.