September 13, 2022

What to Watch - Equity Valuations & Recessions

Despite a resilient labor market, macro headlines and client conversations continue to be dominated by recession fears…and we believe for good reason. Putting the current backdrop in context, never in history has the Fed hiked rates with inflation above 5% and been able to get inflation under control without a recession.

Source: Bloomberg LP from 12/1/1965 – 12/1/2021

Despite these fears, equity valuations remain comfortably above prior recessionary levels, as hopes of a Fed soft landing remain alive. How does this stack up to past recessions? In this week’s commentary, we take a look at historical valuations around recessions; when they have peaked, when they have bottomed, and what this may mean for investors today.

Big Decline, But Not Yet Recessionary

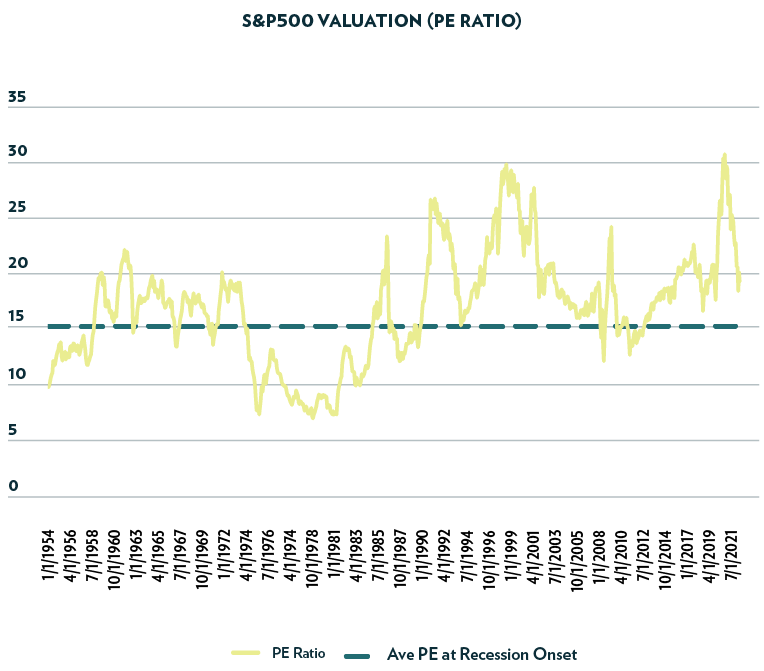

Higher interest rates have driven equity valuations lower in 2022. The PE on the S&P 500 Index has moved from 24X to start the year, to 19X today, dragging the market lower. Even with the large decline, however, valuations remain elevated at around 25% above the historical average valuation at recession onset (see chart below). Should the narrow path to a soft-landing fade, and markets fully discount the prospect of a recession, valuations will likely have further to fall.

Source: Bloomberg LP, from 1/1/1954 to 8/31/2022

Valuations Peaked on Average 6-Months Prior to Recession Onset

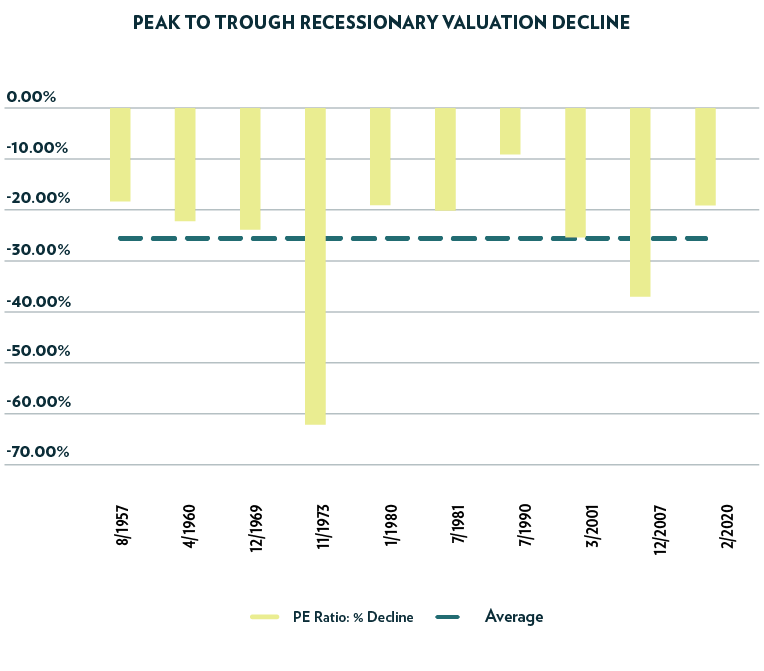

Looking at the last 10 recessions, equity valuations fell 26%, peak to trough, bottoming out at just under 13X earnings, on average. The most extreme drop took place in the recession of 1973 when inflation and the Federal Funds rate were sky rocking. The PE on the S&P 500 dropped 62%, moving from 19X earnings in early 1973 to 7X earnings in early 1975.

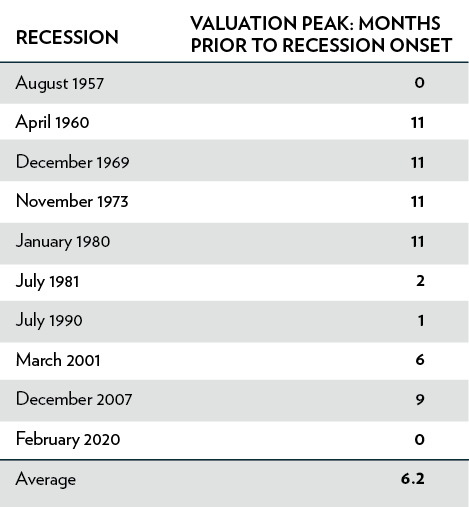

While there has been some variation, the peak on average, has occurred, 6 months prior to the official recession onset.

Source: Bloomberg LP as of 8/31/2022

Source: Bloomberg LP as of 8/31/2022

Valuations Bottom Long Before the Recession Ends

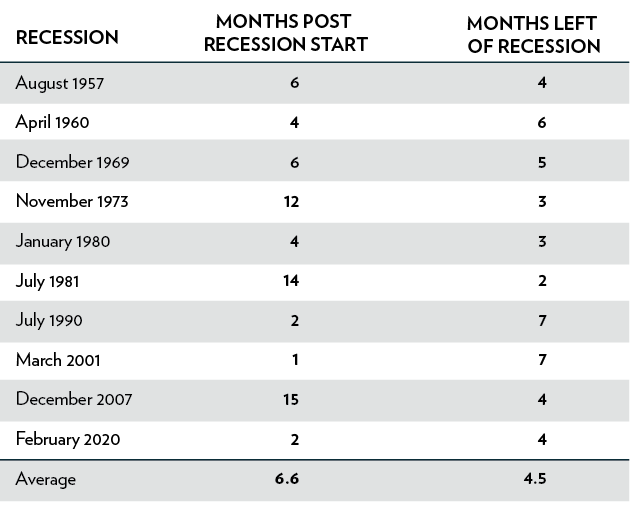

As shown in the table below, on average, valuations bottom 7 months post-recession onset, and begin to rise again around 5 months before the recession ends. Interestingly, in 70% of the in the instances, the valuation bottom occurred prior to the bottom in economic activity (measured by PMIs).

Source: Bloomberg LP as of 8/31/2022

The Bottom Line

While valuations may be more favorable than they were at the start of the year, the market does not appear to be fully discounting the hit to growth that it may take to bring inflation under control. As such, we continue to focus on managing any near-term drawdown risk that may come with a repricing and remaining invested.

The PE ratio is the ratio for valuing a company that measures its current share price relative to its earnings per share (EPS).