August 15, 2022

What to Watch - Soft Landings: Rare but Likely Profitable

Encouraging news on the inflation front this last week as the Consumer Price Index (CPI) came in at +8.5% YoY (+0% MoM) - better than the consensus estimated +8.7% and down from the 9.1% reading the prior month. The equity market rallied on the news in hopes that the Fed will be able to take their foot off the "interest rate accelerator" and potentially even have a shot to pull off a soft landing. While we do not think this is a high probability event, it is important to point out that historically, soft landings, while rare, generally have been highly profitable and resulted in higher equity markets. On the flip side, Fed pivots that lead to a hard landing have been painful for investors and typically result in contracting equity markets.

To provide some historical context, we examined the last four Fed pivots, and highlight just how different the experiences have been for investors. Interestingly, in all four instances, the equity market rallied leading up to and proceeding the Fed pivot, but results were vastly different after the initial run up.

Soft Landings:

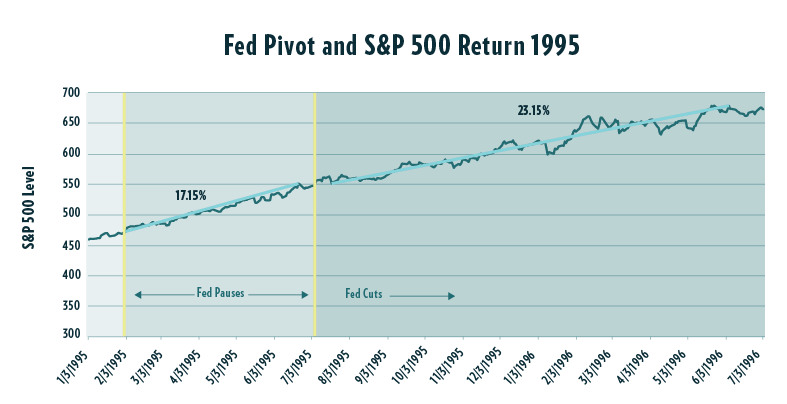

1995

After a cycle of rate hikes in February of 1994, the Fed raised rates 0.50% to 6% in February of 1995 and then paused . The S&P500 railed 17% from the time of pause to the first rate cut, before rallying another 25% in the 12 months following the start of rate cuts.

Past performance is not an indicator of future results. You cannot invest directly in an index.

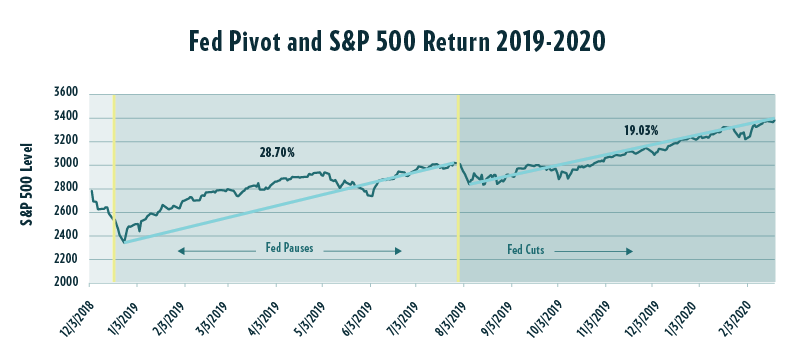

2019

Despite inflation of just 0.1%, the Fed began gradually raising interest rates for the first time since the financial crisis in December of 2015. After a steady dose of 0.25% hikes, the Fed paused in December of 2018. From the final hike to the first cut, the S&P500 rallied 29% and post first cut, the Index rallied an additional 19% to the pre-Covid high.

Past performance is not an indicator of future results. You cannot invest directly in an index.

Hard Landings:

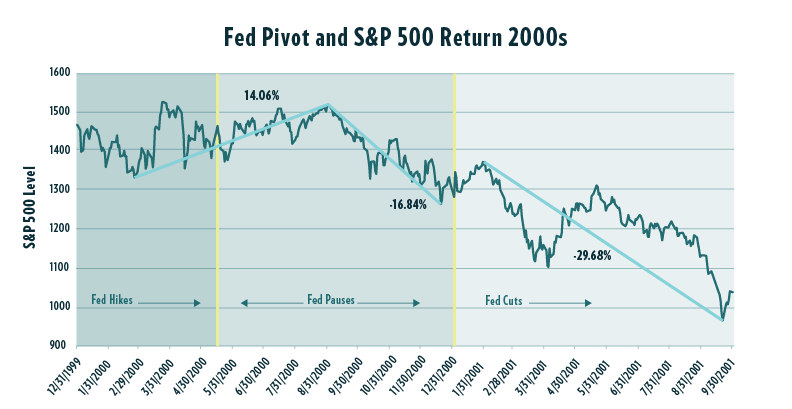

2000

With unemployment at 4% and inflation at just 2.2%, the Fed kicked off a series of hikes in June of 1999, taking the policy rate 4.75% to 6.5% in May of 2000. In the few months preceding the pause, the S&P500 rose 14% into September of 2000, before falling 17% leading up to the first cut. Following the first cut in January, the market made a 7% head fake higher, before falling an additional 30% into September of 2001.

Past performance is not an indicator of future results. You cannot invest directly in an index.

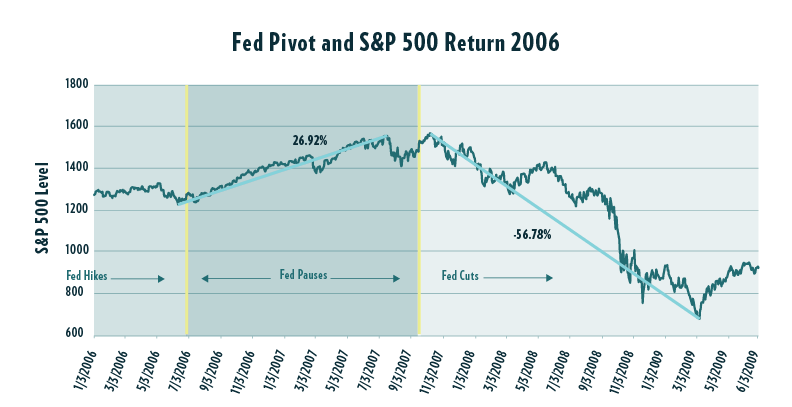

2006

After being appointed Fed chair in February of 2006, Ben Bernanke wasted little time in attacking the overheated housing market, hiking rates from 4.5% in January of 2006 to 5.25% in June. Upon the pause, the S&P 500 rallied 27% from July of 2006 to July of 2007. After a brief 9% selloff, the S&P 500 rallied an additional 10%, in anticipation of and post the first Fed cut, before falling 57% from the high.

Past performance is not an indicator of future results. You cannot invest directly in an index.

Amidst the current backdrop, investors are hopeful that the Fed will slow the pace of rate hikes and even cut rates in the near future. (The recent rally reflects this optimism.) Looking at history, however, it is clearly more important to base investment decisions on where the economy may be heading after a pivot, as opposed to the pivot itself. Soft landings are rare and with the amount of work that remains to get inflation under control, we view this as a low probability event. Nonetheless, in the off chance it does, it is not an event that investors want to be on the sidelines for. Risks are elevated, and in our view skewed to the downside after the recent market rally. However, we believe maintaining exposure to equities while remaining in control of downside risk remains prudent.