Why use Defined Outcome ETF™ investing?

The most common reason for using Defined Outcome ETF™ investing is for the ability to invest with a built-in buffer against losses. Over long periods of time, the stock market has tended to go up. But over shorter periods, stock market losses are common and unpredictable.

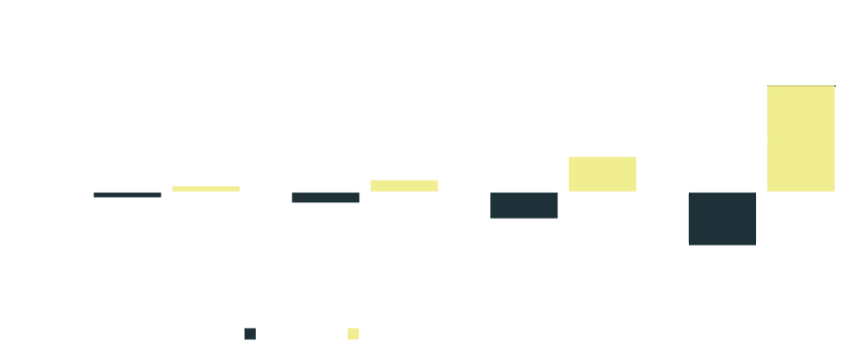

- 75% of all returns were less than 20%, with a median return of 3.6%

- 31% of all returns were negative. The median negative return was -12.0%

- Two-thirds of all positive returns were less than 20%, with a median return of 15.1%

Source: Bloomberg L.P. Past Performance is not indicative of future performance.

Large losses require even larger gains in order to get back to even. Many investors, especially those near or in retirement, don't have time to wait to recover from such a big hit to their portfolio:

Benefits of an ETF Wrapper

Accessing defined outcomes through the ETF wrapper enables investors to benefit from its features, including:

Investor Profiles

Defined Outcome ETF™ investing may appeal to a variety of different investor types for whom managing shorter-term risk is a high priority:

Financial Professional

"I need practical investments that provide a more defined return profile."

"My clients are worried about a pullback in stocks."

"I'm looking for low-cost, defined outcome investment products."

"My institutional clients seek measurable gap risk protection."

Entrepreneur

"I want to participate in market growth (to a cap) but do not want to introduce additional downside risk."

"I want to know my return profile relative to the U.S. stock market before I invest."

"I am concerned about my current risk-management strategy if another '2008' occurs."

Retiree

"I want to participate in the market with built-in buffers against losses."

"I am looking for a potential alternative to other structured outcome investments."

"I can't afford the risk of equities, but also can't afford the low yields of fixed income."