June 29, 2022

Dissecting the Storm Clouds

Tim Urbanowicz, CFA

Head of Research & Investment Strategy

Innovator Capital Management

The consumer is the backbone of the economy, with consumer spending accounting for 68.6% of all US GDP. When spending slows, the ramifications are felt across the board. In the face of red-hot inflation and aggressive tightening from the Fed, the US Personal Consumption Expenditures Index — a broad measure of consumer spending — remained strong.

In other words, people are still buying goods and services, even at these inflated prices, softening the blow to the broader economy. But can this trend continue? In this month’s commentary, we examine three reasons why we believe a slowdown in spending, and hence a slowdown in growth, is coming, and discuss what this might mean for investors.

1. Incomes may be up…but they are not keeping up>

Personal incomes have made steady gains over the past seven months. They just haven’t kept up with the pace of inflation. As of the end of April, incomes were up 1.7% on the year¹ however, after adjusting for inflation, personal incomes had actually taken a hit. This is clearly illustrated in the chart below, where real income (which accounts for inflation) has been steadily declining, despite generally rising wages. Workers may be bringing in more money, but purchasing power is down.

Source: Bloomberg LP, Bureau of Economic Analysis

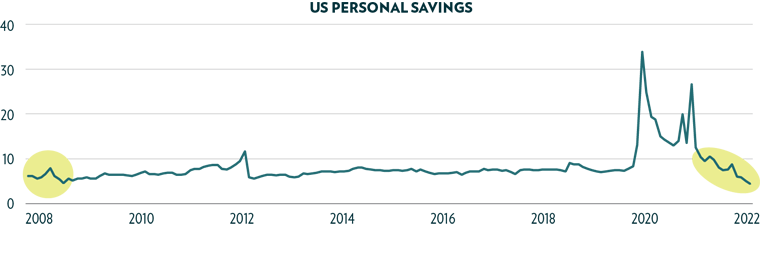

2. Savings are dropping…so is wealth

The question then, is, “Why is real income down, but spending up?” The answer is that consumers are spending their savings. Consumer savings as a percentage of disposable income has plummeted this year, declining from 8.7% at the end of 2021 to just 4.4% at the end of April¹, the lowest reading since September 2008. With less and less to draw on, the slowdown in spending seems to be just a matter of time. In addition, as the majority of financial assets (e.g., stocks and bonds) have taken a major hit, consumers are likely to cut back spending as they see their wealth deteriorate.

Source: Bloomberg LP, Bureau of Economic Analysis

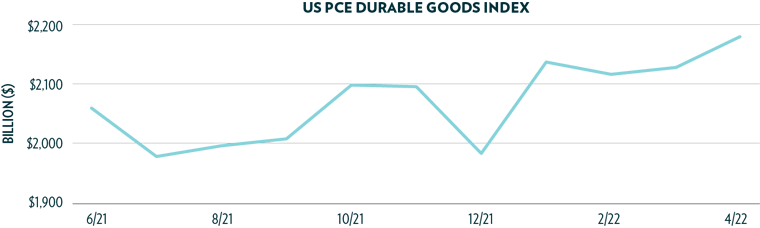

3. Borrowing costs are increasing.

Interest rates have sky rocketed this year across the yield curve. In addition to triggering a repricing of financial assets, the jump has also resulted in dramatically increased borrowing costs, which we believe will translate to reduced spending power for consumers. Spending on durable goods—the goods that typically require financing—remains strong as well. However, in our view, spending will likely taper off toward the back half of the year, as the burden from higher interest rates is realized.

Source: Bloomberg LP

Source: Bloomberg LP, Bureau of Economic Analysis

All-in-all, spending seems ripe for a cooling off period, which is precisely the result the Fed hopes for as they fight to tame inflation. The challenge for the Fed will be doing so without throwing the economy into a recession… something the Fed has historically never been able to do when inflation has been this elevated.

Positioning for the Slowdown

It may serve investors well to prepare for a slowdown, as low (or negative) economic growth makes its way through corporate earnings (at a time when margins are coming down from their peak). We believe hedging equity risk remains crucial, as equities have yet to price in a recession (see last month’s commentary). Should the Fed pull off a miracle, and slow and steady growth return to the market, we believe investors may need to shift from seeking protection, toward solutions that potentially enhance returns, in an effort to combat low growth (and therefore lower equity returns).

1. Source: Bloomberg LP, as of 6/29/2022

The PCE Price Index (PCEPI) is the method used by the Federal Reserve to measure inflation. The PCEPI is based on prices from all households, corporations, and governments, along with gross domestic product (GDP)