September 28, 2022

Historical Tightening Cycles vs. Today

Tom O'Shea, CFA

Director of Investment Strategy

Innovator Capital Management

Last Wednesday’s Federal Open Market Committee (FOMC) meeting concluded with a third consecutive 0.75% rise to the benchmark policy rate, and Federal Reserve Chairman Powell reinforced the Fed’s willingness to endure economic pain in order to squash inflation. Powell’s comments combined with FOMC member projections of tightening by an additional 1.25%, removed any hope that a Fed pivot is coming anytime soon. In response to expectations of higher rates and slower growth, U.S. equity markets (S&P 500) plummeted.

Amidst all the uncertainty across equity and fixed income markets, two fundamental questions remain; How long will the tightening cycle last? And, how severe will the hit to growth be?

Soft Landing Hopes are Fading, Hard Landings Have Been the Norm

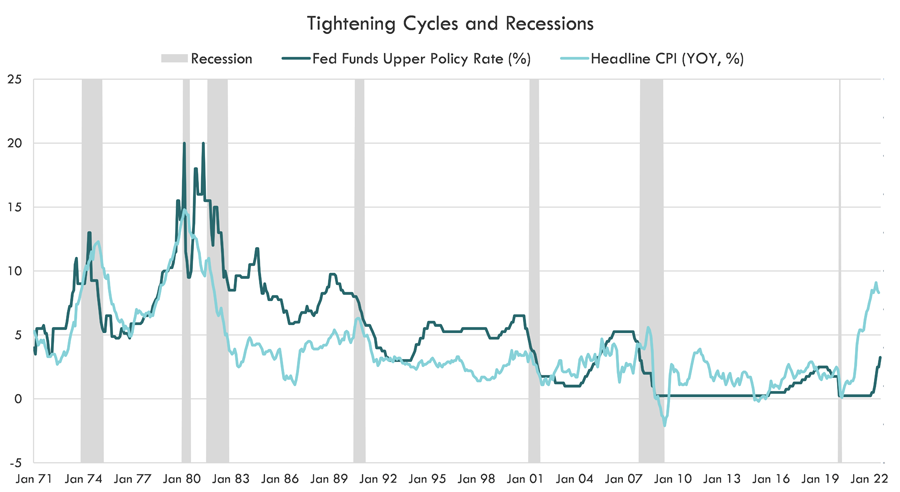

We believe the market’s renewed anticipation of a recession is warranted and will ultimately be needed to fix the issue. Historically speaking, 11 out of 14, or 79%, of Fed tightening cycles since World War II have been followed by a recession within 2 years. When isolating the cycles to periods when inflation was north of 5%, that jumps to 100%.

Source: Bloomberg LP. Fed Funds Upper Policy Rate and Headline Consumer Price Index (YOY,%) is monthly data from 1/31/1971 - 9/22/2022.

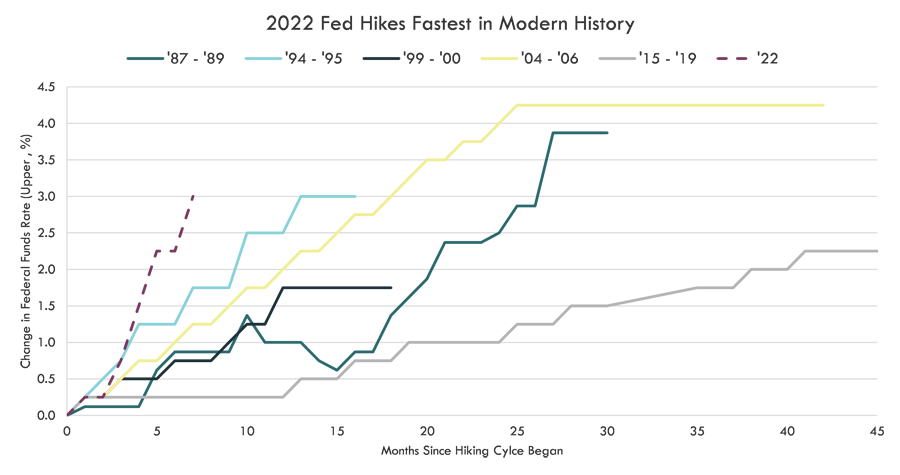

This time around, the Fed is hiking interest rates faster than any other time in modern history in an effort to catch up from their sluggish start. As hikes have historically taken time to make their way into the growth picture, the full effect of these recent aggressive moves remains unknown.

Sources: Bloomberg LP.

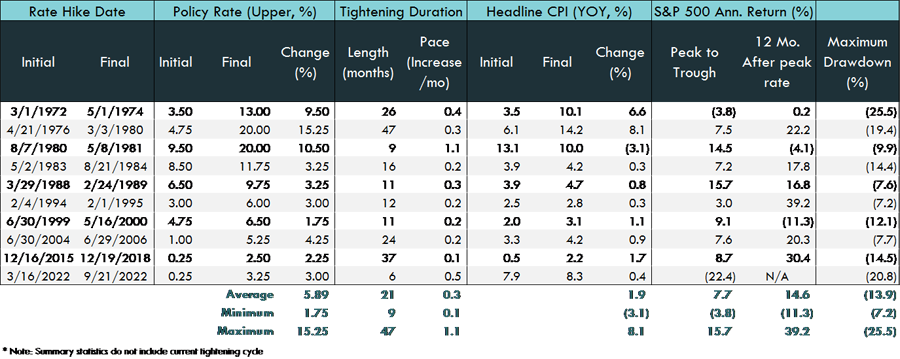

Rate Hikes Take Time to Work... If and When they Do

The table below shows the previous 10 tightening cycles. On average, they lasted 21 months with an average policy rate increase of just under 6%. Interestingly, the average change in headline inflation, from first to last hike, was actually an increase of 1.9%. Despite the Federal Reserve increasing the main policy rate, we see inflation increase in all cycles except for the one beginning in August 1980.

FOMC Tightening Cycles

Source: Bloomberg LP, Federal Reserve Bank of St. Louis.

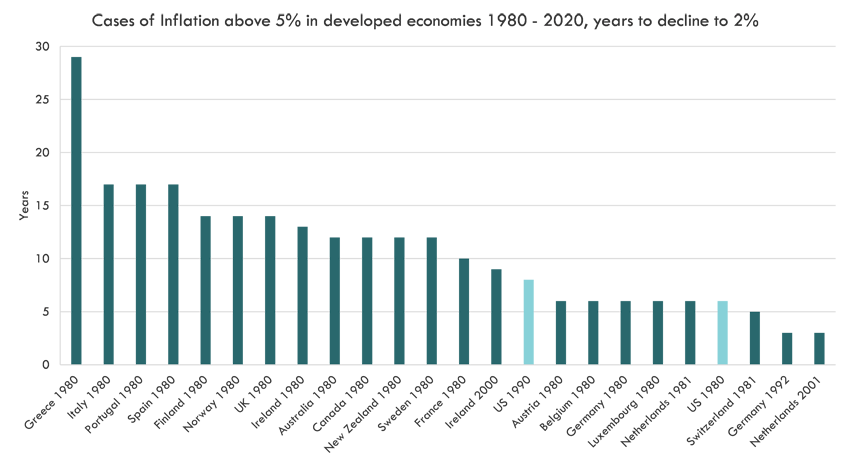

Inflation of 5% More Has Taken an Average of 10 Years to Revert to 2%

Except for the high inflation in the US during the late 1970s and early 1980s, there is not a historical precedent for current price levels. For that reason, we have compared the U.S. to other advanced economies when inflation exceeded 5%. The chart below illustrates how much time has been required for central bank actions to affect prices.

Source: IMF, BofA Global Research.

The Bottom Line

Inflation may have peaked at 9% in June, but we expect prices to remain elevated for the foreseeable future. The perception that inflation is just going to revert back to 2%, as all of the pandemic-related spending fades, could be a costly view, and one that is inconsistent with history. We believe Federal Reserve tightening and balance sheet reduction will act as growth headwinds, and the ultimate hit to growth will be determined by how long policy remains restrictive. Our analysis demonstrates that positive returns are possible in tightening environments but risk management is essential to handle large drawdowns.